Latest News

For years Africa has been a maddening, yet interesting market in the satellite telecom sphere. Even since the 1990s, telcos, analysts, and others within the industry have trumpeted Africa as being a market with enormous potential, and indeed why not? All the fundamentals for a satellite telecom revolution are there: enormous land area, poor ground infrastructure, and a population of more than 1 billion people. Further, people have for years noted something that can sometimes be called the “Mexico phenomenon,” which is more homes in Sub-Saharan Africa have TVs than do refrigerators, an increasingly common developing world trend that was first noted in Mexico a number of years ago. This provides a fertile stomping ground for DTH platforms. All things considered, Africa should be a gold mine for not just gold, but also satellite telecom. And yet, up to this point, it has consistently disappointed.

NSR believes that the coming years could see the continent reach its full potential, and start to demand significant quantities of capacity for a number of applications. 2014 could be an inflection point, with two major deals announced for Sub-Saharan African DTH platform MultiChoice, as well as more launches announced targeting applications such as enterprise data.

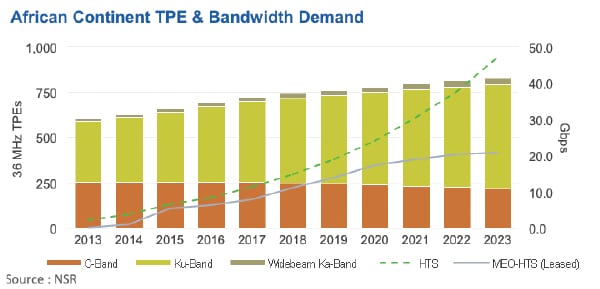

Looking at previous editions of Northern Sky Research’s “Global Satellite Capacity Supply & Demand Study” (GSCSD11) — known as “Global Assessment of Satellite Supply & Demand” prior to this year’s 11th edition — and comparing them to the most current edition of the study, the results for Africa are especially interesting. For example, looking at GSCSD11’s 2013 base year data, which is based upon actual leasing, the number of Transponder Equivalents (TPEs) leased in Ku band was 217.5. This compares to, in GASSD7, published in 2009, at which time the high growth rate projection for 2013 was just more than 200 TPEs. Indeed, it does seem as though Africa may have turned a corner and, moving forward, NSR expects strong growth in the region.

Demand growth in Africa will have several main drivers. For traditional FSS Capacity, Ku band will be the saving grace for the continent, with well over 200 TPEs of new demand coming online by 2023. This will be driven in large part by video distribution, which will account for nearly half of all Ku-band TPE growth. In short, Africa is dozens of countries with even more languages, and in many cases every single country has at least one FTA bouquet or national TV offering. Again, looking at the lack of fiber throughout the continent, it is therefore not surprising that even a national TV channel offering would need to be transmitted largely via satellite.

Beyond video distribution, NSR expects DTH to provide solid demand growth as a secondary application, coming from the fact that, in the face of MultiChoice’s dominance of the continent, there are a number of regional players that are experiencing faster growth due to more customized and specialized content, and consumers’ being turned off by MultiChoice’s essential monopoly on the industry. In short, there will be significant FSS demand growth in Sub-Saharan Africa moving forward, though with a lot of new supply coming online, it is still not as clear whether there will be a significant jump in fill rates.

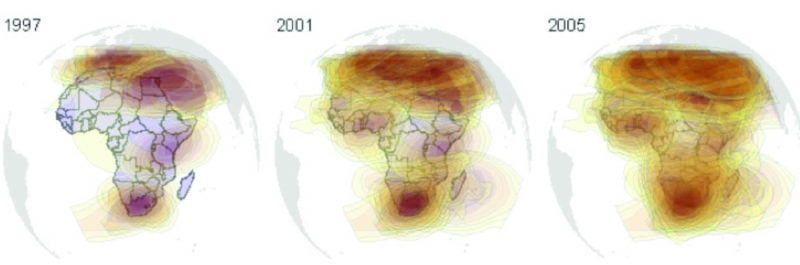

The maps above depict the extent of Ku-band coverage over Africa between 1997 and 2005, a clear testament that this was the “un-connected” continent and would need as much satellite capacity as one could provide. However, bets made by large companies — be it telcos such as Bharti Airtel with their acquisition of Zain, or satellite operators such as Intelsat’s 15+ launches in as many years with Middle East & Africa coverage — are still to pay off as planned.

NSR expects that Africa will continue to see growth in satellite capacity on the supply side, adding about 100 TPEs between now and 2016. Post 2016 and well into the next decade, NSR expects contraction in both C-band and Ku-band as fill rates remain below 50 percent and 65 percent respectively. About half of this capacity comes from satellites that were planned about half a decade ago but are only just seeing the light of day.

The bigger operators were first to the party, and they enjoyed the premium pricing that was once the norm for African satellite capacity. This meant deals in Ku-band at the tune of $5,000 per MHz — a figure that has been cut to size with the plethora of operators entering the market. Most small operators run lesser overheads by not employing a direct sales team in the continent and serving Africa out of the Middle East or Europe. In addition, very few operators have invested in teleports thereby limiting the managed services they can offer, opting for raw sales of MHz instead. With a lack of differentiation between one kind of FSS capacity and another, the result has been a falling price per MHz. While the “connecting of the continent” has been good for satellite manufacturers, operators have had to contend with many small VSAT networks shutting down as fiber began to make inroads along the coastal countries. Since the video market remained a near monopoly, the smaller operators could not succeed in selling bulk bandwidth and the only way to sell became to drop the price on FSS capacity and focus on plans for HTS supply.

HTS will be the type of capacity that benefits most from the genuine need in Sub-Saharan Africa for connectivity. As noted above, fiber penetration and infrastructure development levels in Africa are poor. As such, two major applications will come into play that will help HTS boost demand: broadband access, and enterprise data. Enterprise data will largely be backhaul and IP trunking, methods of bringing about connectivity. By 2023, it is expected that nearly 50 Gbps of HTS demand will have come about in Africa, with just under 90 percent coming from the two applications mentioned above. Beyond that, applications such as commercial mobility and government/military will play an important role as well, and by 2023 it is forecast that more than $300 million of annual revenues will be coming from the African continent’s demand for HTS supply, an increase of over 30-fold from 2013.

This will all be supplemented by MEO-HTS, which will see around 20 Gbps of demand corresponding to more than $100 million in revenues by 2023.

Bottom line, even though FSS capacity will see very strong growth rates in Africa moving forward, that is not to say that HTS will be forgotten, and indeed with the number of new HTS payloads expected to be launched over the continent in the coming years, this will prove to be an inflection point in terms of HTS as well.

In the broader context, Africa remains one of those regions that has leap-frogged over terrestrial rollout of broadband, directly to mobile wireless. If populations in urban cities continue to grow rapidly, terrestrial providers and their towers may end up being more efficient at delivering a lower cost per bit for broadband than even HTS-based VSAT systems aspire to be. Who “wins” is yet to be seen but either way, the African customer definitely gets more choice for connectivity.

Bottom Line

NSR believes that Africa is primed for excellent growth across both Ku-band and HTS offerings. Driven by DTH and distribution via Ku-band, as well as enterprise data, broadband access, and others in HTS, the future is bright for satellite telecom demand in Africa, with supply leveling off long-term and fill rates catching up moving forward. Pricing and profitability are not as simple to crack and as is the law of the jungle: it will be survival of the fittest. VS

Prashant Butani is a senior analyst with NSR. His areas of expertise include satellite capacity supply and demand, DTH, satellite manufacturing, satellite launch and emerging media applications.

Blaine Curcio is a senior analyst with NSR. His areas of coverage include general FSS market tendencies, development of HTS, and a focus on emerging markets, in particular East Asia.

Get the latest Via Satellite news!

Subscribe Now