Latest News

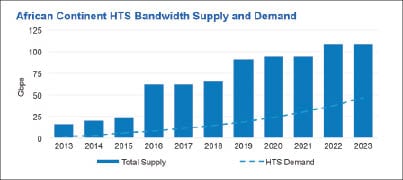

Africa remains a hotspot for satellite services. With a number of operators looking to carve out a niche for themselves, the region is a tough market to predict. A potential over-supply situation in traditional C- and Ku-band capacity, questions as to what the drive to data will mean for the industry, and whether High Throughput Satellites (HTS) can be key in powering local economies in the region, make this a challenging but vibrant market for satellite.

The last few years have seen a significant evolution in spacecraft technology. New satellite designs employ spot beam architectures, higher frequencies, and even different types of orbits to create the potential to deliver higher performance and faster data rates than traditional C- and Ku-band geosynchronous satellites, serving successfully traditional markets and covering large geographical areas using single-beam transmission. Now, there is demand for two-way broadband access over large geographical areas not served by telecommunications infrastructure. Demand for High Throughput Satellites (HTS) could be on the increase.

“The near-term influx of capacity into Africa — from both satellite operators and fiber — has led to a supply and demand imbalance,” says Grant Marais, Intelsat’s regional VP of Africa sales. However, a report released by Ericsson in June forecasts that mobile data traffic will grow 20 fold between the end of 2013 and the end of 2019 in Sub-Saharan Africa. Mobile network operators will need robust solutions that provide the needed speed and reliability for even the most remote areas. Over the long-term, according to Intelsat, demand will be there.

The way to guard against market uncertainty is to lock countries’ needs through hosted payload approaches rather than normal marketing activities, according to Khalid Balkheyour, CEO of Arabsat.

Eyal Copitt, VP of marketing and sales for Africa and Asia at Spacecom, highlights the fact that, while Africa is witnessing an appetite for investments in infrastructure as economies look to grow (especially with varied geographies and long distances within nations), satellite operators are making smart investments rather than throwing money to create markets. Copitt says Spacecom sees a growing market in Africa, especially for broadband Internet applications, where the operator sees a “great deal of potential.” Copitt admits Spacecom has “great aspirations” for its business in Africa. “ The evolution — in fact, revolution — in smartphone and tablet usage is an excellent example proving that and adding further need for satellite-based operations,” adds Copitt.

Certainly, it is hard to see another continent in the world where there are so many satellite operators vying for a share of the market. A number of new players, such as O3b Networks and Azerscosmos to name but two, are also focusing on Africa trying to carve out their own specific niche. Steve Collar, CEO of O3b Networks, says he does not believe there is an oversupply of capacity in Africa through new HTS initiatives. “As demand for data increases and operators move to 3G and beyond, the traditional 2 Mbps voice circuits stop being so interesting,” he says. “Operators need to be able to provide a lot more for a lot less and you need a different kind of satellite to deliver that. I don’t think HTS creates oversupply. I think HTS is trying to address the demand that exists today and, as a result, less differentiated capacity becomes less interesting.”

Wesley Wong, CTO of Azercosmos added that, as the appetite for broadband connectivity grows in Africa, the opportunities will also expand. “Developing the right business plan to take advantage of this opportunity will be the key to playing a successful part in capturing market share in Africa,” he says.

End User Perspective

There are also a number of other players looking for satellite capacity; from new DTH platforms and broadcasters, to oil and gas companies mining key offshore locations. In a recent interview with Via Satellite, CIO of Tullow Oil Andrew Marks said that he had seen minimal change in the VSAT providers’ position in recent times. Marks added that, as more fiber is being laid around the coastlines of major continents, more fiber means more bandwidth, greater redundancy and resilience, and more competition for low latency connectivity. This means Tullow might rely less on satellite connectivity in the future. Since the company has a strong presence in Africa, Marks comments’ are clearly concerning.

O3b, however, is deploying its first sites in Angola. In this case, it is onshore and, once it has that deployed, it will go offshore with that particular company and others in Africa. In terms of the demand from the oil and gas market, Collar adds, “Demands for bandwidth are really increasing here. They are going from 5 Mbps requirements to 10 Mbps requirements. One of the big oil & gas companies had an RFP out on the street, which was calling for 10 Mbps to a given site. Once they had seen what we could do, the RFP was reissued at 50 Mbps and with low latency specified. That reflected the fact that our link could enable applications to run over the circuit that aren’t possible over GEO and drive operational efficiencies for them.”

Coppit believes the influx of fiber into Africa actually works in satellites’ favor. “We have always said that more fiber drives further growth for satellite. Fiber creates additional services that reach larger segments of the population and, as people become accustomed to improved and various services, demand for these services also increases in all areas, including massive areas only serviced by satellite,” he says.

Collar says the Internet in Africa is mainly mobile and delivered through mobile technologies. “What we are seeing is that the arrival of fiber on the coasts has stimulated the demand in places that either don’t have fiber or the fiber availability or reliability is very, very poor. An example is what we deployed in Kinshasa three months ago with our customer, Raga Telecom, with an initial commitment of 2 STN-1s, so about 300 Mbps — that is the demand they saw in Kinshasa for our services. We are now up to commitments in Kinshasa of more than 1 Gbps.”

Marais adds that hybrid use of satellite and fiber is regularly used across a wide range of industries, and the growing demand for bandwidth driven by increased use of the Internet and social media networks will certainly drive the demand for satellites to bring connectivity to previously unconnected areas as part of hybrid communications networks.

“What we may see in the future is a change in the application, but [satellite] will always be there. Examples for satellite fit in the value chain are: direct broadband to consumer, Internet trunks to ISPs, GSM backhauling to telecom operators, connectivity between local telephony exchange and main exchange, connectivity between fiber base station and in-land stations, in addition to Point to multipoint video distribution and contribution and Backhaul to WiMax stations,” Balkheyour says.

Opportunities

The capacity provided by HTS, such as Intelsat’s EpicNG will enable new applications and solutions in every sector — broadband, cell backhaul, and mobility. With its carrier-grade service and open-architecture format, Intelsat EpicNG was designed with all of these needs in mind. For example, the ability to use satellite to cost-effectively expand cell backhaul and enterprise networks will have an immediate impact in countries where terrain limits the ability to expand, enabling operators to enhance the reach and power of their networks and provide benefits to the end users.

In terms of potential hotspots for HTS in Africa, and outside of South Africa, Collar points to a number of interesting country markets where he feels HTS and high capacity satellites could make an impact. “You have countries like DRC, Ethiopia, significant parts of West Africa including Liberia, Angola, Sierra Leone, Chad, [and] Central African Republic where there could be strong demands for HTS capacity. So, all these countries that tend to be landlocked still require significant connectivity,” he says. “I think for the satellite market in general, Africa is a continent in transition. You have got one large dominant DTH provider, and a handful of smaller providers that are more regionally focused and break meaningfully into the market. You have a mobile industry that is transitioning from 2G voice and into 3G outside the main cities.”

Wong says that, in the long run, many countries in Africa can benefit from HTS. However, he believes that, in the near term, countries showing the strongest economic growth are in the best position to take advantage of HTS by partnering with other regional operators to improve the overall economics of an HTS. “HTS can be a good way to reach an entire country’s population and serve as a key part of the telecommunications foundation for years to come. When viewed as a complementary technology, it can expedite the roll-out of more wireless and terrestrial technologies where the economics makes the most senses,” he adds.

Ultimately, African governments could also look to embrace satellite connectivity, with current demands coming from telcos and mobile operators. “We don’t necessarily see African governments stepping up and deploying rural connectivity programs the way we see in Latin America, for example,” Collar says. “Mobile operators in Africa are driving quite hard to drive beyond the reach of the core network. Over the next year, that is where we will see more of the growth. It is inescapable that broadband penetration and GDP growth are closely tied. So governments, over time, will acknowledge and act on that. There remain challenges with power and other core services that need addressing but Internet and connectivity is a fundamental enabler for everything else. We will start to see that recognized by the African governments before too long.” VS

Mark Holmes is the editorial director of Via Satellite and Avionics magazines.

Get the latest Via Satellite news!

Subscribe Now