Latest News

One of the key advantages of the VSAT business is its ability to rapidly react and adapt to change. This has become very apparent over the past couple of years, which has seen the industry suffer from the effects of economic uncertainty and competition from alternative technology options. It took a while for the effects of the global economic crisis to influence the performance of the VSAT market but, as weaker economies, declining trade and budget cuts began to bite even in mission-critical communications networking, so did competitive technologies and networks, the investment for which had been laid down years before.

The effect was seen everywhere, but African markets illustrated the problems on a greater scale than most, as fiber systems and 3G/LTE roll-outs suddenly negated much of the coverage advantage of VSAT and intense competition between terrestrial providers brought massive price erosion. Suddenly, the vulnerabilities that COMSYS had been warning about for some years — the reliance on simple bandwidth provision and connectivity above network value and the concentration of deployments in major cities which ultimately became the low hanging fruit for investment in terrestrial infrastructure — hit home. This, coupled with weaker economies and political turmoil, caused falling sales in countries as far apart as Argentina and Russia and from the Pacific Islands to Kazakhstan. After years of steadily increasing numbers of sites in service we saw declines for the first time from 2011 onwards with the wind-down of military activities in the Middle East and, more recently in Afghanistan, further contributing to the difficulties operators faced.

Other market changes also heralded growing issues that highlighted shortcomings in the technology. Bandwidth requirements across the spectrum, from consumer to corporate, rose dramatically — often doubling over a 12-month period — and VSAT operators scrambled to assemble solutions that could maximize bandwidth efficiency and address these needs. This worked for a while, but high satellite capacity costs and VSAT system performance limitations began to hamper sales. This set the scene for the industry as it entered 2012. It was clear that some major changes were required if the technology were to maintain its relevance.

As we skip forward to the first half of 2014 and the conclusions of the VSAT Report, one of the key advantages of the VSAT business is very much in evidence: its ability to rapidly react and adapt to change. Whilst it is true that the satellite operators had been pushed into investing in high-throughput, multi-beam, multi-gateway satellites that deliver a much lower cost per bit, this has been driven by the consumer market in North America and brings almost as many limitations as it does advantages, especially for the enterprise and corporate segments of the market.

Change at the space-segment level takes time, but the VSAT system vendors have shown a remarkable capacity to innovate extremely fast when required and, with increased hardware capabilities, operators have demonstrated that they too can adapt their strategies and business models very rapidly. It is a valid criticism that vendors sat on their hands for longer than was really comfortable, but by 2012 the understanding was manifest and by 2013 almost every single VSAT system manufacturer had either developed or was close to finalizing new product platforms that brought massive increases in performance and greater levels of application integration.

Flexibility is the underlying mantra behind technical innovation in the ground segment. From Hughes’ HT/Jupiter platform’s abilities to serve as a mass consumer system to an enterprise operator’s hub, to ViaSat’s multi-waveform Chameleon modem and from the software-defined functionality of systems from Romantis and ND SatCom to the advanced antenna designs from Kymeta and Phasor, engineering developments promise a wave of new technologies over the next few years that have the potential to revolutionize VSAT’s ability to deliver innovative services to a highly demanding market. iDirect is leading the charge into a throughput boost for VSAT terminals that will bring performance to spare and allow operators and customers alike to serve intensive applications well into the future. All of the manufacturers plan major new product releases during 2014 giving an assurance for future applicability on a scale we have not seen in the past.

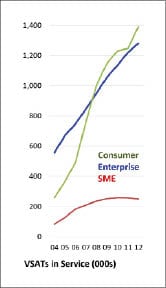

These developments have led to a complete and dramatic change of tempo in the market. Growth has come with a major series of changes which have brought a trifurcation of the primary areas of business into specialized and high value corporate and mobility networking; an increasingly hybridized part of the total end user connectivity solution; and, Internet access bridging the digital divide and serving the consumer. Sales leapt and the number of VSAT sites in service resumed their upwards course. In 2012 the market grew by all major measures — global VSAT service revenues increased by $200 million to $7.2 billion and hardware revenues rose to over $1 billion on the back of a 12 percent growth in shipments. The number of VSAT sites in service topped 2.9 million across all services with the greater capabilities that the technology introduced particularly evident in the U.S. consumer business where Hughes and ViaSat brought the world’s largest satellites into service and began delivering performance based on their Jupiter and SurfBeam 2 network platforms that catalyzed the market. Consumer subscribers climbed by 11.6 percent even before HughesNet and Exede brought in record subscriber acquisitions in 2013.

Stronger sales in the enterprise business were primarily the result of large deployments for government and financial applications as the need to extend connectivity and government services gained ground in many countries and several large programs were initiated or extended. On a smaller scale, sales through carriers for network extension and business continuity coupled with specialist services for maritime, cellular backhaul and utilities also grew robustly. On the downside, the market for managed broadband access services continued to soften, especially in the Middle East and North America, although service in Africa recovered far faster than had been expected. This was helped by Ka-band spot-beam services from Avanti and Yahsat finding traction in the SME segment, which compensated for slower penetration of international consumer markets.

VSAT operators have also raised their game with more global infrastructure on a local scale, different investment models and a greater focus on core service areas — too much diversity is becoming the kiss of death. Even as terrestrial fiber and wireless services have expanded, VSAT technology has grown to take a growing importance in mainstream telecoms solutions as it has been adopted by carriers for network extension, business continuity and overlay networks. A number of service providers have now mastered the art of providing a seamless service, which leverages the advantages of VSAT in an integrated solution. At the same time, operators in the specialized corporate networking segment have been growing their capabilities organically and through acquisition that has brought a new level of competitiveness amongst mid-tier operators following the giant M&A creations of 2010/2011. There are those that foresee a continued decline in the number of VSAT operators as a consequence of consolidation, global networking requirements and an increasingly competitive environment. COMSYS however, subscribes to the view that the technology will always encourage diversity and as consolidators build through acquisition, so entrepreneurs will create opportunities and exploit new markets based on the highly versatile platforms now available and the inevitable decline in satellite capacity pricing. The latter is already evident in the markets that enjoy coverage from Yahsat, Avanti, IPStar and Telesat where, in some cases, we have witnessed price reductions of between 30 and 60 per cent. With Inmarsat, Intelsat, SES/O3b, Eutelsat, NewSat, NBN Co. and many others committed to major investments in new, and in some cases, innovative satellite platforms, this trend is likely to continue.

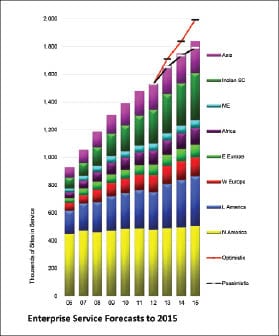

Our primary research and forecasts show that the market grew well in 2013 and will continue to grow through 2015. However, as we suggested two years ago, the areas of opportunity are much patchier than has historically been the case. In 2009 operators generally felt upbeat with many reporting that the economic downturn had had only a minimal effect on their businesses, but this had changed by 2011 with business becoming much harder to come by, greater price pressure and more competition from newly available terrestrial services. 2012 saw a marked revival of fortunes, with the majority of operators reporting better prospects and projects that had been put on hold being re-activated. During the research for the 13th Edition of The VSAT Report, a good proportion of operators expressed real concern about the need to transition business models to find viability in a telecoms environment where VSAT is often used in combination with a terrestrial service. The roles of extension and back-up are becoming far more prevalent and primary network opportunities in which VSAT provides the main or only connectivity are now in the minority except for high end corporate applications that often serve customers with no other alternative. In the case of a mobility application this is almost always true, but with corporate sites for an NGO, O&G land office, mine or regional bank there is now often a terrestrial option and satellite takes a back-up role. Nevertheless, good opportunities also exist in the government, banking, utility, energy and mobility segments and we expect to see the market grow by 6 per cent in 2014 and 5 per cent in 2015 with Latin America, India and Asia providing the best prospects.

Flexibility and response have risen as important requirements and have undoubtedly become a VSAT differentiator, but VSAT operators also need to prepare for the future and lay some firm foundations. A key question that needs to be addressed is how to incorporate the growing proliferation of lower cost, but more fragmented spot-beam capacity in a service provider’s business model. In many instances, adoption of a particular service capability might require a shift in control from infrastructure ownership to reliance on a managed service and a new role as a reseller. A move into lower cost Ka-band service packages might be seen as an advantage, but equally a value proposition that seeks to leverage more individual network control coupled with the higher availability of Ku and C-band services could also serve as a strategy. However, this is not a black and white decision and some operators have already decided on an integrated approach that combines the advantages of both. Whatever the answer is, VSAT operators, large and small, need to understand their options, consider the impacts and adopt a position now.

Nevertheless, in order to take full advantage of the advances in satellite design, the lead set by IPStar and Avanti in opening up their satellite systems and gateways to alternative VSAT systems will need to become more widespread. Intelsat’s more flexible open architecture EpicNG design also points the way forward to a solution that combines the advantages of spot-beam technology with the existing infrastructure and operational expertise of the current operator ecosystem. Ultimately, closed systems and commoditized services will not play to the strengths of operational diversity that is a hallmark of the VSAT industry. For many this means tying the capabilities of VSAT to the infrastructure and customer knowledge required to deliver services with a unique twist that brings profitability and defensibility. Adding the fact that many of the latest generation of VSAT products now incorporate a modular system design that offer the potential to be deployed cost effectively in a multi-gateway environment, the building blocks for future service growth are now firmly established.

Unquestionably, bandwidth use is increasing dramatically and expectations are such that companies and individuals expect to have almost universal access wherever they are. Whether the location is on a tanker in the mid-Atlantic or a suburb with patchy DSL, a mine in Burkina Faso or a hotel in the mid-west of the United States, an NGO office in South Sudan or an airline passenger above the Atlantic, a platoon commander in the mountains of Afghanistan or a cellular subscriber in Japan in the aftermath of that dreadful tsunami, the only technology that is all pervasive, available almost anywhere in a reliable and cost-effective solution is satellite-based VSAT. Welcome to the real cloud. VS

Simon Bull is a senior consultant at COMSYS and the principal author of “The VSAT Report.”

Get the latest Via Satellite news!

Subscribe Now