Latest News

Contrary to popular belief, aircraft connectivity is not a new segment of the satellite business, but it has been increasingly rising in exposure recently with the spotlight shining on its most glamorous market, the passenger in-flight entertainment and connectivity (IFEC) market.

The excitement brought about by in-flight Wi-Fi services on aircraft has led the march for service differentiation in the cut-throat air travel market, and even low-cost airlines such as JetBlue Airways are joining the fray; it even chose a market penetration strategy that is second to none: offer Wi-Fi for free (at least for a limited period). So while most airlines ponder the best business models, it is not a question of what but rather when will they provide Wi-Fi and data services via satellite.

Small is Beautiful

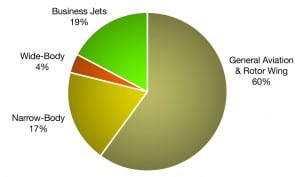

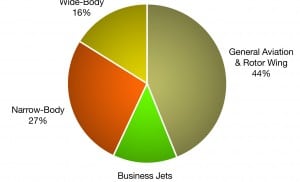

However, amidst this enthusiasm, there is a simple truth that is often forgotten about satellite communications and airplanes: general aviation (small planes, bush flying, air ambulance) and rotary-wing airframes (civil helicopters, military transport and combat rotor-wing airframes) drive volumes. And that volume represents today about 60 percent of the addressable market, far ahead of wide-body and narrow-body aircraft such as the B737s or the A320s. It is mainly an L-band equipment play with a high potential for basic communications services for safety of flight for tracking, weather alerts and location-based services that is on a path of slow but continuous growth. The smaller airframes market today represents about 53 percent of all in-service units installed, but that dominant position will decrease to 44 percent in the coming decade as a shift occurs not only in the installation rate on other airframes but also the services and frequency bands for satellite connectivity.

Raising Bandwidth

With projections for new aircraft deliveries hovering at around 1,100 annually for the next decade, and airline traffic growing almost 6 percent last year, the market for wide-body and narrow-body aircraft is likely to grow quite a bit. The price of equipment is still what makes customers cringe the most when asked if they will install a satellite antenna, but OEM deals with Boeing and Airbus may counter this argument. These companies now offer factory-options for many airframes that translate customer connectivity needs from the initial aircraft order, which will drive market penetration.

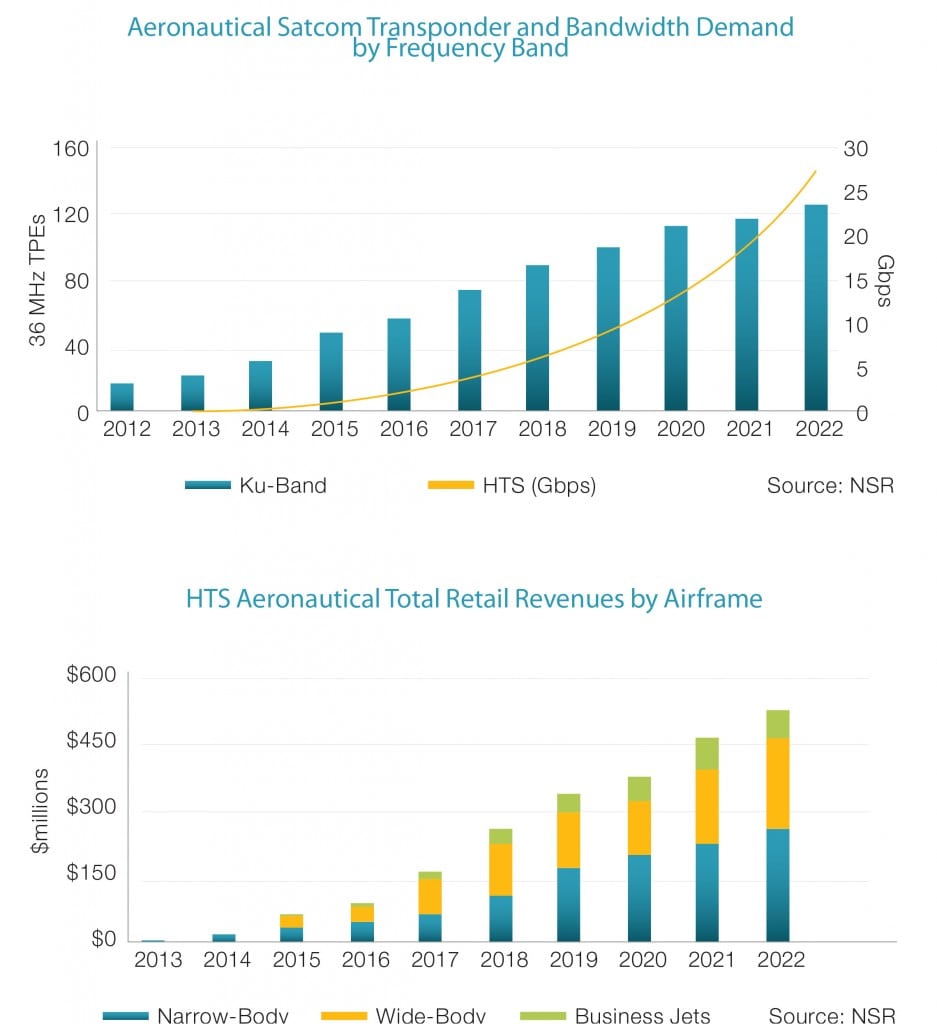

The business jet market is not to be ignored either, but it is the darling of many operators such as GoGo, ViaSat and Iridium. It has been on the upswing in the past five years with OEM deals signed with Bombardier, Cessna, Hawker, Boeing, Dassault and Gulfstream ready to serve bits in the air for their demanding customer set. The big driver here will be Internet connectivity and, to a lesser extent, data and video, and not just from the cabin but also from the cockpit. These bandwidth-hungry customers will take the lead on a per unit basis followed by wide-body airframes and narrow-body users. This is already visible through the large deployment rate of Ku-band broadband that offers more capacity and the upcoming start of HTS services on airlines such as JetBlue and United Continental.

Pushing the Threshold

Indeed, the uptake of Ku-band connectivity, which has now reached beyond North America and is growing in Europe and parts of Asia, will show a compound annual growth rate in the next five years.

Get the latest Via Satellite news!

Subscribe Now