Latest News

Photo: Via Satellite

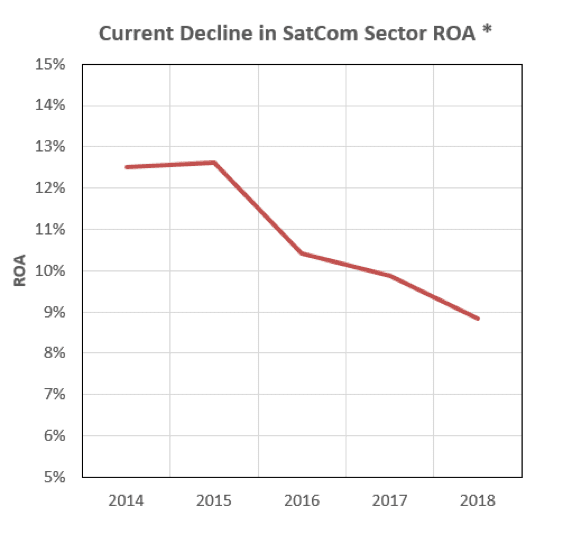

In the face of dwindling Returns on Assets (ROA) due to the inexorable slide in broadband connectivity pricing ($/Mbps/pcm), and the prospect of further swathes of space capacity being launched by new entrants, satcom Internet of Things (IoT) is one example of how a “ROA mindset” can encourage satellite network operators to differentiate by developing additional services and new income streams from their core assets. Northern Sky Research estimates that the satcom IoT pie will have grown to $5 billion by 2025.

*Note 1: Aggregated data summed over four large publicly listed operators with varied geography, technology and business models including:

*Note 1: Aggregated data summed over four large publicly listed operators with varied geography, technology and business models including:

- European MSS operator with mix of wholesale and direct revenues

- American MSS operator with wholesale revenues only

- American FSS operator with direct revenues only

- European FSS and MSS operator with mix of wholesale and direct revenues

Why Focus on ROA?

The core assets of a satellite network operator include: satellites, ground infrastructure, spectrum and orbit slots, whilst their primary revenue streams are directly correlated with broadband data rates (Mbps). But this direct linkage with data rates has caused satellite network operator ROA (measure of EBIT over Assets) to slide, due to declining broadband pricing and overcapacity.

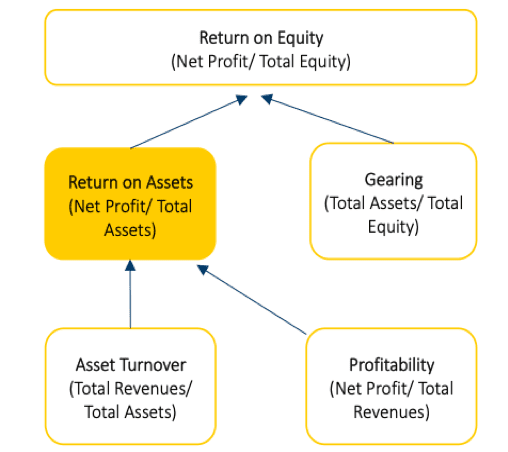

Rather than responding with financial leverage (gearing) or launching ever-cheaper swathes of space capacity, adopting an “ROA mindset” is a return to fundamentals that will reward satcom investors.

ROA is uninfluenced by financial engineering such as debt leverage and less vulnerable to short-term gaming that can occur on income statements, reflecting the fact that satcom assets (satellites, spectrum, ground infrastructure and intangibles) are a result of long-term decisions. Also, ROA, as seen above, is the product of asset turnover and profitability, two business efficiency metrics that usually come from focused long-term decision-making. This makes ROA a holistic, long-term, decision-based metric to measure company performance and especially suited for a long-term investment infrastructure industry such as satcom.

Declining ROA: Is There Worse Yet to Come?

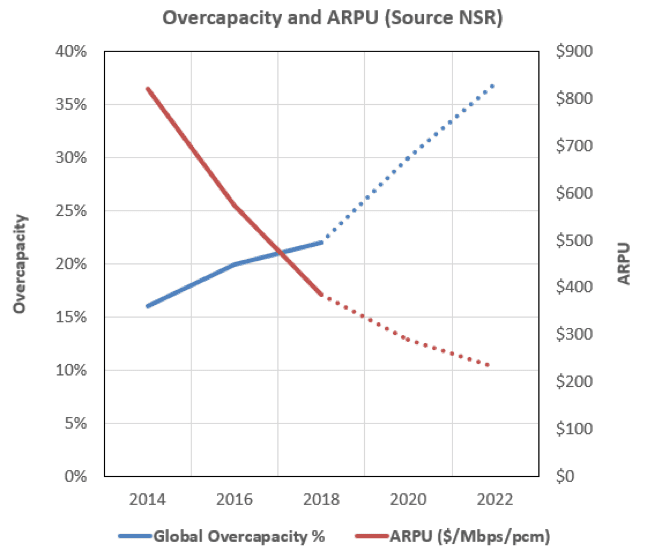

The recent decline in satcom ROA is largely caused by lower asset turnover ratios, owing to the oversupply of capacity and a resulting downward pressure on operator ARPU (figures below provided by NSR).

Broadband capacity ARPU has declined approximately 30 percent every two years for the last decade and a further 40 percent decline is forecast between now and 2022 (see dotted lines above). Meanwhile, the total capex cost to launch and supply Mbps from space continues reducing by around 60 percent over each successive generation of satellites, further fueling the overcapacity trend as new Low-Earth Orbit (LEO) entrants begin jostling for position alongside the incumbents in the coming years. Factoring in these increased levels of competition, it seems prudent to assume that asset turnover and ROA will both continue being placed under considerable pressure.

Renewed Focus Onto Raising ROA

Satcom operators must continue investing in assets. But if the traditional model of selling Mbps is to remain under sustained pressure, they will ultimately need to find new ways to improve both the asset turnover and profitability of their business models to stabilize and drive up ROA.

Boosting ROA With IoT

Fundamentally, this can only be achieved by investing into projects that deliver above average returns for modest-to-lower utilization of core infrastructure assets. Interestingly, IoT fits the bill as a strong contender to boost ROA. This might seem counterintuitive at first, since IoT ARPUs can be much lower than broadband, but the satellite IoT market is growing aggressively to reach $5 billion by 2025, giving opportunity to improve revenues in a different segment, one that is not characterized by racing to provide additional space capacity.

Note 2: A mere 10 Gbps of global IoT space capacity is sufficient to serve the connectivity demands of around three billion asset tracking devices or around 600 billion smart meters!

Incumbent SatCom operators are well positioned to offer new IoT services to existing customers, leveraging existing terminal equipment they may already have located at the customer’s premises. For new entrants, having an IoT-capable terminal is a significant added value to sell to the end customer. Moreover, new satcom IoT services extend the reach of satellite operators into their customers’ valuable digital transformation strategies, where digital transformation technology platforms can be “developed once and sold many times,” opening up new revenue streams that are uncorrelated with broadband data rates (Mbps) and pointing to the opportunity to forge new partnerships in the IoT value chain.

Finding the Right Partner to Boost ROA

Satellite operators have a plethora of choices to integrate their own services with specific IoT partners. This approach requires little or no investment into core infrastructure assets, which makes it a positive driver for ROA. Instead, it requires the development of a suitable channel strategy to attract a high volume of low ARPU subscribers onto the network in a cost-effective manner.

Putting the Spotlight Onto Non-Core Satcom Assets

For many operators, new entrants and incumbents alike, one area where additional capital investment could certainly lead to above average returns is the development of low-cost IoT waveforms, terminals and hubs, which are key determinants for total system capacity and efficient spectrum asset utilization. Incidentally, this is one good reason why a growing number of SatCom operators are choosing to participate in 3GPP activities to define satellite compatible waveforms and protocols for 5G New Radio, hoping that a standards-based approach may go some way to help spread their capex burden. At any rate, low-cost IoT capable terminals will be the catalyst required to unlock the IoT business opportunity for many operators.

Conclusion

Rather than focusing on building capability and financial leverage to launch ever-cheaper swathes of space capacity, adopting an “ROA mindset” will benefit the whole industry and encourage operators to differentiate themselves by developing and offering additional services from their assets. Whether this will be achieved through new partnerships with IoT service providers or focusing capital spending on non-core assets remains a key point of strategy. But finding creative ways to monetize a fuller suite of services from the same underlying infrastructure will become increasingly vital if the current overcapacity trends in satcom are allowed to continue unchecked.

Adrian Hillier is a consultant at the Technology Partnership (TTP).

Adrian Hillier is a consultant at the Technology Partnership (TTP).

Sumesh Puthiyaveetil is a product management executive in the communications industry.

Sumesh Puthiyaveetil is a product management executive in the communications industry.

Get the latest Via Satellite news!

Subscribe Now