Latest News

[Via Satellite 07-30-2015] Telesat expects it will order a previously announced replacement satellite by the end of this year. The new satellite would replace Telstar 18, which is currently in orbit at 138 degrees east providing coverage for the Asia-Pacific.

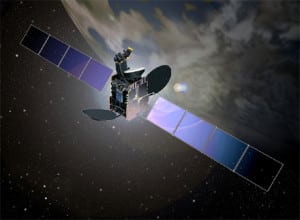

Telstar 18 entered service in 2004 and has a 13-year lifespan. The satellite carries 18 C-band transponders and 10 Ku-band. The replacement to Telstar 18 would follow Telesat’s progress with its other satellite project, Telstar 12 Vantage.

“Our Telstar 12 Vantage program is on schedule at this point in time and we expect to launch the satellite toward the end of this year,” Dan Goldberg, president and CEO of Telesat, said during the company’s July 30, second quarter earnings call. “Telstar 12 Vantage, which will replace and expand upon the capacity and coverage of our Telstar 12 satellite is being built by Airbus and will be launched by Mitsubishi Heavy Industries. We expect to enter into an agreement before the end of this year for a replacement satellite for our Telstar 18 satellite.”

Goldberg said Telesat’s fleet utilization stood at 94 percent during Q2 for North America, and 80 percent for international. From a revenue perspective, North America accounted for 81 percent of revenue, Latin America 9 percent, Europe, the Middle East and Africa (EMEA) region 7 percent, and Asia 3 percent. Telesat’s upcoming Telstar 12 Vantage satellite will carry a mix of traditional regional beams and high throughput spot beams. Goldberg said the future Telstar 18 successor is likely to include some High Throughput Satellite (HTS) capabilities as well.

Telstar 12 Vantage will be located at 15 degrees west, where it will cover Europe, the Middle East, South America, much of Africa, and some of North America. Goldberg noted interest among maritime customers for higher throughput services. He said Telstar 12 Vantage will provide high throughput capacity over the Mediterranean and high performance beams over the Caribbean and the North Sea.

Amid challenges facing the launch sector with delay-inducing setbacks from Proton and Falcon 9 rocket failures, Goldberg praised MHI’s H2A rocket as a “very reliable launch vehicle.” While many operators are currently waiting with longanimity until vehicle issues are sorted out, Telesat’s late 2015 launch window remains the same. Goldberg declined to mention a specific launch date, but said the mission is expected to happen in either November or December. Telstar 12 Vantage is MHI’s first commercial satellite launch order.

Telesat’s backlog for future services is CA$4.6 billion ($3.5 billion). When adjusted for foreign exchange rate changes, revenue for the three months ended June 30 decreased by 4 percent compared to the same period in 2014. Telesat attributed the decrease primarily to lower revenue from international satellite services and lower equipment sales. Goldberg mentioned an increasingly competitive environment in certain markets as something the company is paying greater attention to.

“We’ve seen it in Asia, we’ve seen some of that in Latin America. Some of that is a function of what’s happening in Brazil with the Real deteriorating quite a bit in terms of its value relative to the U.S. dollar … overall [there is] a heightened competitive pressure. To date nothing too material but it’s certainly something we are keeping an eye on,” he said.

Telesat reported consolidated revenue of CA$227 million ($174.5 million) for the quarter ended June 30, an increase of CA$1 million ($770,000) compared to the same period in 2014. For the six-month period also ended June 30, the company’s consolidated revenue was CA$456 million ($351 million), a decrease of CA$12 million ($9.2 million) compared to the same period in 2014. Goldberg said these numbers were impacted by the U.S. dollar, which was 13 percent stronger during the first half of 2015 than it was during the first half of 2014. Because of this, Telesat was positively impacted on the conversion of U.S. dollar denominated revenue, but negatively impacted by the conversion of U.S. dollar denominated expenses.

Get the latest Via Satellite news!

Subscribe Now