Latest News

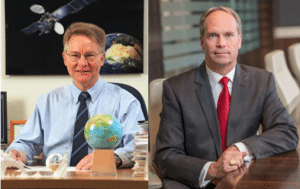

Orbital Sciences President and CEO David Thompson on the left, and ATK President and CEO Mark DeYoung on the right. Photos: ATK and Orbital Sciences

[Via Satellite 02-19-2015] In the first conference call following their merger, David Thompson, CEO of Orbital ATK, unveiled the recently integrated company to investors and analysts alongside post-merger outlooks and business strategy. Orbital Sciences and Alliant Techsystems (ATK) announced the $5-billion merger last spring and completed it, with few bumps in the road, earlier this month — just a few months after the original December 2014 completion date. With Thompson, Orbital’s former president and CEO, manning the helm for both companies, and Mark DeYoung, former president and CEO of ATK, moving to a new role as chairman and CEO of ATK’s Sporting Group spun off as Vista Outdoor, the company is moving forward in terms of furthering projects and business strategies already in place as well as streamlining operations and executing additional initiatives.

“[We have] a dozen or so major new products — more than half of which Orbital and ATK developed cooperatively — that have been introduced in the last 15 years and that have accounted for over 40 percent of our total revenue each year,” Thompson told investors and analysts on the call. “From these enviable competitive positions, the company’s post-merger strategy will continue to apply our historical advantages in life-cycle, product innovation and consistent operational execution in consistent operational affordability.”

Headquartered in Dulles, Va. — the former Orbital Sciences headquarters location — the new $4.5-billion defense, space and aviation systems manufacturer will merge ATK’s rocket manufacturing capabilities and Orbital’s satellite, launch vehicle and spacecraft manufacturing. Orbital ATK will focus on rocket propulsion systems, satellite and space systems, and airspace structures, with the largest chunk of revenue, nearly 40 percent, coming from defense products. The new company employs more than 12,000 people and serves customers in the United States government and commercial markets as well as international clients through three operating groups: flight systems, defense systems, and space systems.

Presenting pro-forma calendar year 2014 financial results as a baseline for the new company’s progress, Thompson reported $4.4 billion in revenue from the companies over the last year. Despite the Antares launch failure in early November 2014, the financial guidance didn’t come as much of a surprise, according to Raymond James analyst Chris Quilty. But the call did indicate that a bright future may lay ahead in way of the company’s three-year outlook and beyond.

“The merger clearly creates a much more capable mid- to upper-tier player in the market that will likely compete for larger programs with the traditional primes,” Quilty told Via Satellite.

Thompson hinted at the company’s winning a continuation of its Commercial Resupply Services (CRS) contract, which would bring in solid revenue for years to come. Using the Cygnus capsule, Orbital Sciences delivered food, equipment and experiments to the International Space Station, along with an increasing number of small satellites for customers such as Planet Labs. Within six months, Orbital ATK will be ready to launch the first enhanced Cygnus from Cape Canaveral, Fla. By March 1, 2016, the company is expecting to launch the next Cygnus on the upgraded Antares rocket.

“We’re still on track to complete all of the deliveries as required under the original CRS 1 contract by the end of 2016, and we still see that being accomplished with no adverse financial impact to the company,” said Thompson. In the coming year, Orbital ATK will strive to win the CRS 2 contract alongside the CRS 1 contract extension, for which a decision is expected from NASA in June.

Extra space in the budget for government projects may also up projections for the new company. With 56 percent of its customer base coming from the U.S. defense market and an additional 18 percent in the NASA and civil government market, plans to nix sequestration and up aerospace and defense funding in President Obama’s 2016 budget, currently making its way through Congress, may open even more doors.

As Orbital ATK launches into streamlining operations in an effort to reduce overhead and up profit margins — including nearly 500 personnel reductions — it looks to add value through three new features. “First: Additional cost reductions that will be sought through greater vertical integration and merger-enabled overhead efficiencies. Second: Additional revenue opportunities that will be pursued due to greater systems engineering know-how and strengthened technical and industrial resources. And third: A substantially increased capacity for capital deployment that will be available to improve investment returns,” Thompson said.

Get the latest Via Satellite news!

Subscribe Now