Latest News

[Via Satellite 06-16-2014] Northern Sky Research (NSR) analysts see lots of growth stemming from the use of High Throughput Satellites (HTS) between now and 2023. In a webinar based on the “Wireless Backhaul, Trunking and Video Offload via Satellite, 8th Edition” report, NSR predicts that a growing number of satellite services will shift from Fixed Satellite Services (FSS) to HTS platforms over the coming years.

Looking at various sectors, the research firm pointed to backhaul on mobility platforms a source of high growth opportunities. On the other hand, wireless backhaul on land-based towers represented a brownfield market where better cost structures are needed to guarantee a worthwhile Return on Investment (ROI). North America, in particular, is immersed in terrestrial microwave and wired connectivity. The satellite industry will play an increasingly important role in this region, which NSR attributes to HTS.

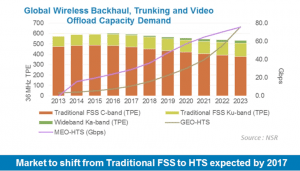

Traditional FSS C-band is not expected to maintain market dominance with the high costs associated with backhaul for fixed land-based towers. Based on 2013 numbers, wireless backhaul by satellite is conducted today by traditional FSS using C- and Ku-band 84 percent of the time. Geostationary HTS comprised the remaining 16 percent, but NSR foresees a major change in the not too distant future.

“[By 2023] the largest portion [will be Geostationary Orbit] (GEO) HTS. That’s where that shift occurs in the next 10 years and we do feel pretty confident about that,” said Christopher Baugh, president of NSR. “When you add in GEO HTS and [Medium Earth Orbit] (MEO) HTS together, you are looking at a really big chunk of this market. Traditional markets such as C- and Ku-band … will still have almost a quarter of the revenue, but it is definitely a shift that is undoubtedly happening, driven by the higher data rates [and] higher needs over the next 10 years which these advanced HTS support.”

Cellular backhaul in particular is accelerating in terms of data rates. NSR expects mobility platforms to drive industry growth as 2G/2.5G installations are superseded by 3G/4G deployments. The research firm also expects small-cell and picocell demand to outpace macrocells, and for Single Channel Per Carrier (SCPC)/ Time Division Multiple Access (TDMA) systems that use traditional FSS C- and Ku-band to play a lesser role as HTS constellations come online.

Commercial aircraft connectivity, in particular, is a market Baugh said has surpassed NSR’s predictions. Currently there are more than 8,700 connected aircraft using services from Gogo, OnAir, Panasonic Avionics, Row44 and ViaSat. He warned that though there is a lot of excitement, there is still a need to turn a profit from offering In-Flight Connectivity (IFC). Airlines increasingly see these services as distinctive or even essential, but methods of monetization vary.

“The key thing is the business case of many of these service providers is still to be determined. We know there is a lot of interest; we are in a ‘land-grab’ phase, but there is definitely a lot of upside here for satellite companies. There are still things to be worked out, but we still feel pretty positive about this opportunity,” said Baugh.

Video offloading by satellite remains a “wildcard,” according to Baugh. While it can be bundled with packaged wireless backhaul or trunking, this market has yet to prove itself viable for satellite. There are several factors that could swing it either way. What remained undisputed is that video is a large user of bandwidth and is only on the rise. Citing Ericsson, mobile traffic from video, which accounted for roughly 40 percent of mobile data traffic in 2013, will exceed 50 percent by 2019. The adoption of Ultra-HD could further accelerate satellite bandwidth usage.

“The market potential could be many times our projections. If video is the big clogging factor in the network, as we have heard over and over again, if that is the issue, then this could even have play in the developed markets if it becomes a bigger problem than it is today, and if the terrestrial spectrum continues to be the bottleneck,” said Baugh.

NSR analysts do not see video offload having market play in highly developed markets such as North America and Western Europe, again due to the high level of existing terrestrial options. Should satellite serve as a backup role to urban fiber, it could gain a foothold. Otherwise the bulk of the opportunities lies in Asia, Latin America and Sub-Saharan Africa. NSR expects video offload deployments to follow the growth of HTS. Still, little traction is predicted anywhere geographically in this market until 2017.

Jose Del Rosario, research director for NSR also commented on the possible role of a massive constellation by the likes of Google or Facebook. Both are reminiscent of a previous large-scale Low Earth Orbiting (LEO) constellation project by a company called Teledesic that grew too costly and was never completed. While the satellite plans of today’s Internet giants remain unclear, NSR said that the amount of bandwidth made available by such a constellation of hundreds or more satellites would certainly find a niche in the market today.

“Ericsson was tracking the market for data voice and video since 2010, and the explosion happened — that was the inflection point in 2010. So we think a short answer to the question is that Teledesic was probably too early for its time, but given the requirements today, Teledesic, or what Google or Facebook hope to do … may be a little bit behind because the terrestrial networks are being overburdened now,” said Del Rosario. “The difference is on the demand side. … The requirements on the ground have really outpaced the 1990s.”

Get the latest Via Satellite news!

Subscribe Now