Latest News

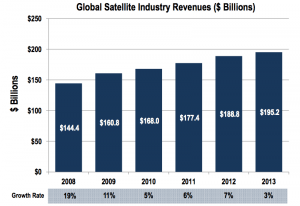

[Via Satellite 05-28-2014] The Satellite Industry Association (SIA) released its 17th annual report recapping how the industry faired for the past year. The study, performed by the Tauri Group, found the satellite industry’s growth slightly outdid both worldwide and United States growth rates and brought in $195 billion in revenue for 2013.

Overall the industry grew by 3 percent, a slight edge over U.S. economic growth of 2.8 percent and slightly more than the global average of 2.4 percent. Satellite contributed 60 percent of revenues for the total space industry, and contributed 4 percent of revenues for global telecommunications. With close to 1,200 satellites operating today, SIA reported that global industry revenues have nearly tripled since 2004, averaging an annual growth rate of 11 percent.

Satellite services — the largest sector of the industry — grew by 5 percent, spearheaded by consumer demand. Satellite consumer services generated $97.9 billion in revenue, of which $92 billion came from satellite television. The year 2013 saw approximately 200 million satellite TV subscribers with growth driven by emerging markets such as India and Russia, which contributed substantially to new these numbers.

The transition to High Definition (HD) over standard channels continued to drive up the need for bandwidth, as HD frequently augments or completely replaces standard channels over time. The number of HD channels increased by 14 percent from 2012 to 2013, driving the need for new satellite TV ground equipment, especially in Europe and Asia. The bulk of HD channels serve the Americas. SIA’s report made no mention of Ultra-HD.

Fixed Satellite Services (FSS) stayed relatively flat for the year. Transponder agreements and managed revenues showed little sway in either direction revenue-wise. Meanwhile, remote sensing showed an impressive 16 percent increase in revenue. Established companies such as DigitalGlobe and Airbus Defence and Space contributed to the gain, as well as new entrants such as Skybox Imaging and Planet Labs. Government sales continued to be the main driver of demand for Earth observation (EO).

The U.S. saw its share of global revenues from satellite manufacturing increase to 70 percent, a rise of 10 points from 2012. Communications satellites — both military and civil — comprised close to half of all revenues. Military surveillance contributed just shy of a third of 2013 revenues, and the remaining 20 percent came from remote sensing, scientific, and Research and Development (R&D) satellites.

CubeSats were the neoteric favorite for R&D satellites. In total, 91 CubeSats were launched in 2013, more than the last eight years combined. These small spacecraft cost on average roughly $100,000 to launch. Only eight of the 91 CubeSats were commercial, serving EO or communication purposes. The rest served mainly as prototypes for testing or R&D. All CubeSats are currently in Low Earth Orbit (LEO), though there are developments to reach Geostationary Orbit (GEO) in late 2015. NASA is also considering deep space CubeSat missions that could cost $3 to $10 billion.

SIA reported that the launch industry had a decrease in revenue of 7 percent following the previous year’s meteoric 21 percent growth rate. The lower revenues were attributed to fewer high-cost launches. The report counted orders by launch, not by satellite. Most commercial launch revenues came from the U.S., though Europe’s Arianespace retained the largest number of orders, winning 18 of the 32 launch orders for the year.

Ground equipment saw modest growth of 1 percent from 2012 to 2013. The U.S. market earned 43 percent of all ground equipment revenue for the year. Global Navigation Satellite System (GNSS) equipment comprised 57 percent of revenues, down 3 percent from the year before. Network equipment revenues dropped 10 percent as well. The bulk of the growth came from consumer equipment purchases for satellite-enabled broadband, TV, radio and mobile terminals. With the rise of GNSS-enabled devices only expected to increase, nearly half of the attributed revenues came from chipset Location-Based Services (LBS) embedded in phones, tablets and other mobile devices.

Using data from the third quarter of 2013, SIA and the Tauri Group estimated that satellite industry employment in the U.S. has almost stopped decreasing. From 2008 to 2012, the U.S. satellite industry shrunk by 10 percent. According to SIA, Q3 2013 saw a decrease of about 0.1 percent, or roughly 250 jobs. Satellite manufacturing and ground equipment continued to lose jobs year over year, while satellite services and the launch industry experienced employment gains. SIA noted that employment by individual segments is showing signs of recovery.

Get the latest Via Satellite news!

Subscribe Now