Latest News

[Via Satellite 01-13-2014] Com Dev International found more of its growth in 2013 outside the borders of the United States. In a conference call, Michael Pley, president and CEO of Com Dev, said that the company will continue to rescale its U.S. operations, and that it still has positive long term prospects in the country. However, Com Dev’s majority owned Canada-based subsidiary exactEarth was mentioned as bringing an affirming light to the quarter.

“We expect revenue at exactEarth to grow year over year at about the same 25 percent rate that we saw this past year,” said Pley. “It is on track to achieve bottom-line profitability in fiscal 2015 as planned.”

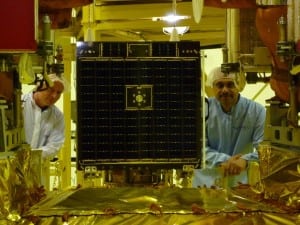

ExactEarth switched from a negative Earnings Before Interest Taxes Depreciation and Amortization (EBITDA) of $2.7 million in fiscal 2012, to a positive EBITDA of $0.4 million. The subsidiary’s customer base nearly doubled, increasing from 54 at the start of 2013 up to 100. ExactEarth makes use of several small satellites built by Com Dev and SpaceQuest to provide Automatic Identification Systems (AIS) for maritime customers.

“We have seen this joint venture subsidiary advance from a concept to an essential tool used by governments, agencies and individuals for safety and security on the seas worldwide,” said Pley. “With the EV 5 satellite coming into service this month and the launch of the M3M microsatellite this May, exactEarth’s service offering will be even better and more attractive to potential customers. We now have a growing subscription-based recurring revenue stream to contribute to earnings.”

Com Dev also discussed the completion of an International Financial Reporting Standards (IFRS) five-year projection, which found that an impairment loss had to be acknowledged.

“Ultimately, the analysis compares the discounted cash flows that are expected from the business, and compares them to the carrying value of the long lived assets, property, plant equipment and intangibles,” explained Pley. “When the carrying value of those assets is greater than the discounted cash flows of the business as determined in the analysis, impairment exists under IFRS, and an impairment loss must be recognized. That impairment loss amounted to $3.5 million, and the company recorded it in Q4. It is important to note that this is not a cash charge,” he cautioned. “It’s also important to note that our view of the longer term prospects in the U.S. remain positive.”

Revenue in the fourth quarter of 2013 was down 5 percent from the same quarter in 2012. The revenue decrease and impairment loss were both attributed to the effects of the U.S. federal government’s sequestration. Overall the quarter was still strong, with Com Dev booking $87.9 million in new orders, which included its largest commercial order ever received. Much of the company’s positive growth came from new space policy agendas in Canada and the United Kingdom.

“The U.K. space agency for example has been actively creating international partnerships with the intention of increasing exports related to Earth observation, remote sensing and small satellites … we are pleased to see the Canadian government is increasing its commitment to the Emerson Commission report, which endorses a similar view to the U.K. government,” said Pley. “The report recommended the creation of a long-term space policy framework, a renewed emphasis on space technology development, and partnerships between government, academia and industry.”

Much of Com Dev’s backlog comes from these countries, which boosted yearly results. The company’s backlog at Oct. 31, 2013 was $164.7 million, its highest year-end backlog since they began tracking in 2006. Revenue also increased year over year by 3.3 percent, up to $215.5 million as compared to $208.6 million in fiscal year 2012. Despite having a slower fourth quarter, the company is confident that opportunities will reemerge in the U.S. government market, and it looks to continue growing through new possible mergers.

“We believe we are in a great position to achieve strategic acquisitions,” said Pley. “Our strategy would be to look at space industry companies that produce components complimentary to our own product offering, or will allow us to diversify our customer base.”

Get the latest Via Satellite news!

Subscribe Now