Latest News

Via Satellite illustration.

This is the second of a two-part series analyzing the value of edge computing in space by the Boston Consulting Group. Read Part One: Size of the Prize: How Will Edge Computing in Space Drive Value Creation?

What key drivers are necessary to ensure that edge computing in space is widely adopted to the degree that it reaches an inflection point of affordability? We at the Boston Consulting Group believe that cybersecurity, cost, and ESG will drive the market for edge computing in space.

Cybersecurity is an area in which edge computing offers distinct advantages. Cloud computing is vulnerable to the ever-increasing risk of cybersecurity breaches, which can lead to major data theft or loss. Organizations across industries that collect personally identifiable information on a public cloud expose themselves to liability and/or compliance concerns, while sensitive intellectual property and proprietary industry data can become vulnerable to cybersecurity attacks at various nodes of transmission – particularly given growing dependency on cloud computing.

The main challenge presented by the current cloud computing landscape is that corporate services and data are entrusted to third parties and are exposed to a higher level of risk, both in terms of security and privacy. The top three threats to cloud systems are unsafe API interfaces, data loss or theft, and hardware failure. The widespread use of virtualization in the implementation of cloud infrastructure also creates security problems because it alters the relationship between operating systems and underlying hardware, introducing an additional level that must be managed and protected.

In contrast, edge computing introduces multiple advantages for cybersecurity since data is processed locally. This eliminates risks stemming from data transfers, which are typically encrypted and inevitable when using typical terrestrial cloud solutions. With edge computing, complex calculations occur at the IoT device/perimeter server level and the only transfer is that of the final result to the user. The risk of data loss is driven more by damage to local servers, rather than cybersecurity vulnerabilities.

[Hear more: Sita Sonty talks with N2K Space about edge computing in the T-Minus Space Daily podcast]

Cost also presents an area of advantage to edge computing. Organizations could achieve operational cost savings by using edge computing due to the minimal need to move data to the cloud. Since data is processed at the same location where it is generated (in this case, on the satellites themselves, collecting imagery through hyperspectral or SAR capability or remote sensing data), processing these batches of data on the same satellite would also yield a significant reduction in the bandwidth needed to handle the data load.

Hosting applications and data on centralized hosting platforms or centers creates latency when users try to use them over the internet. Large physical distances coupled with network congestion or outages can delay data movement across the network. This then delays any analytics and decision-making processes.

Edge computing in space, in this context, could enable data to be accessed and processed with little or no obstacles, even when there is poor internet connectivity. Importantly, if there is failure with one edge device, it will not destroy the operation of the other edge devices in the ecosystem, facilitating a reliable, connected system.

Finally, there are potential gains to be achieved in terms of ESG metrics by adopting in-space edge computing capability. With the cloud business model dominating, there are emerging concerns about the environmental effects of centralized processing. Processing centers require enormous resources to function; they contribute to carbon emissions, accounting for 0.6% of all greenhouse gas emissions, and produce electronic waste, adding to the burden humans put on the environment in pursuit of advancement.

Edge computing has become a potential alternative to moving data centers to greener practices. The edge helps reduce the networking traffic coming in and out of centralized servers, reducing bandwidth and energy drains. This frees up bandwidth at the data center itself and bandwidth for the organization, overall, in terms of any centralized servers on-premises. Moving edge computing to space would achieve even further reductions in energy consumption required at the terrestrial data center level, while the needs for temperature control and cooling would be eliminated by the freezing temperatures in LEO.

Sizing The Prize

In order to estimate an overall market for edge computing in space and explain why in-space edge computing capability and associated user interface applications need to be built, we triangulated three approaches to the market: Supply, Demand, and Cost.

Today, roughly 20% of data processing and analysis occurs locally, with 80% happening in centralized data centers and computing facilities.

We developed a high, low, and base case for estimating the share of industry addressable by space solutions, and as a core assumption of the model, we used reliance on cybersecurity to gauge what share of industry would be addressable by space. With this model, we expect an estimated $250 million market by 2030 with defense and satcom as leading industries for application. However, it is important to note that the estimated $250 million market is addressed by only one segment of the total scope available as one looks at the Edge Computing in Space Capability Stack (Figure 2).

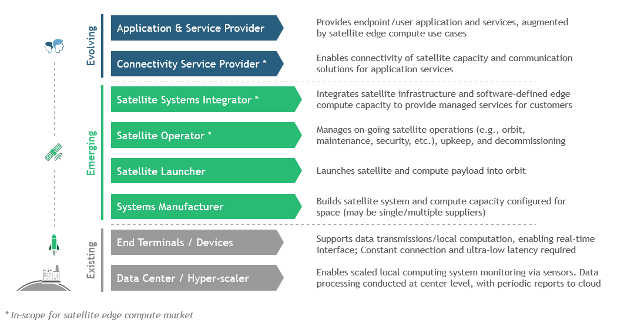

Figure 2: The capability stack for edge computing in space demonstrates the breadth of functions which could be enabled and supported for different end users. Source: BCG analysis.

Further upside would emerge as addressable market opportunity for connectivity service providers (satcom/telecom), applications developers (who would be responsible for developing the apps for the specific government customer to interpret processed information, for example); terminals/user interface manufacturers; and the residual flow down to data centers for cloud computing purposes. Other segments of Edge Computing in Space Capability Stack would see further value unlocked as Edge in Space comes online, delivers key capabilities to the highest need customer groups (e.g., those in defense), and brings the cost curve down for commercial use cases and applications to emerge.

By estimating demand for cloud computing across target industries, supply for satellite revenue in the aggregate space market, and comparing the cost of terrestrial and space data storage centers, we believe that there is more demand for cloud computing in space than the supply of satcom providers.

Our model indicates that the cost to host data in space will closely approach terrestrial data costs past 2030, while on supply and demand, we anticipate more demand for cloud computing space than supply of satcom providers.

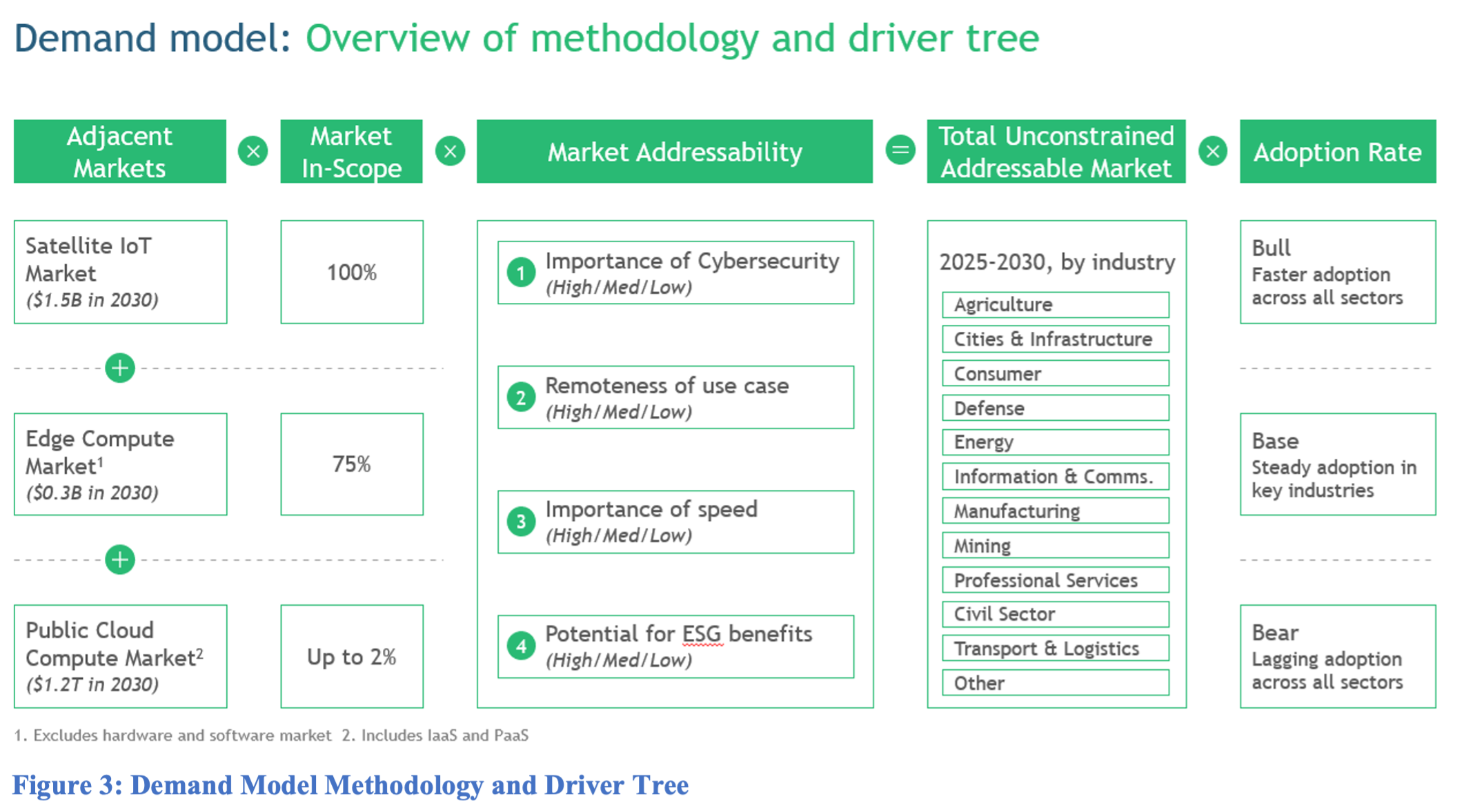

In light of these differentiating factors and our model research, demand for edge computing is established and expected to grow (Figure 3). We project all of Satellite IoT spending, $1.5 billion by 2030, to be addressable given the importance of cybersecurity. We estimate the relevant edge computing market (excluding hardware and non-core service software) to be $0.3 billion by 2030, of which 75% would be in-scope. Finally, we estimate up to 2% of the total $1.2 billion cloud compute market by 2030 to be in-scope due to the selective applicability of cybersecurity and latency needs for real-time analysis.

Figure 3: Demand Model Methodology and Driver Tree

However, research indicates that supply is currently lagging behind expected need due to insufficient public and private investment, with key implications for government and private investors.

The key drivers to understanding which companies will unlock the potential of edge computing in space include prioritizing cybersecurity, lowering cost burden, and adopting ESG practices. With increasing digitalization, the space economy will further benefit from integrating edge computing into space-based business models. However, companies and governments must help develop the needed supply that our current space investment demands.

While cloud computing will remain an integral part of the overall market for the foreseeable future, the advantages offered by edge computing in space are clear enough that actors in the most promising markets of defense and agriculture should be considering the questions posed earlier. For government, how can they leverage this technology to enhance the security of critical assets and information? How should government invest in developing the market for space-based edge computing, and how can they effectively support its growth? What role will incentives play – will they be tied to ESG targets?

For industry, there are questions around how to sell to target customers in key markets such as government and agriculture. Are the start-up and non-recurring engineering costs prohibitive – and what investments and partnerships will be required? What scenarios exist for the development of requisite ground infrastructure?

Go to market success will require integrating the edge computing in space-as-a-service capability into a suite of other services that could already be on offer. In addition, as commercial space stations look to develop edge computing in space offerings, successful methods will integrate this capability among others in orbit, such as where and how remote sensors collect the data, where and how the data analytics are performed, and potentially offering various data streams to the same group(s) of customers utilizing the same sensors to optimize quality and quantity of output.

The space industry is no stranger to partnering closely with suppliers and customers, including governments, to develop and deliver new technology and advance the art of the possible. By making the right investments, governments, investors, and users in edge computing can turn “democratizing space” from an expression into a reality.

This paper is the second two-part series analyzing the value of edge computing in space by the Boston Consulting Group. Read Part One: Size of the Prize: How Will Edge Computing in Space Drive Value Creation?

S. Sita Sonty leads Boston Consulting Group’s Commercial Space team. John Wenstrup is a senior leader in BCG’s Technology, Media & Telecommunications practice. Cameron Scott is Global Sector Lead for Defense and Security. And Dr. Hillary Child is a Project Leader from BCG’s Chicago office.

Additional research by Avril Prakash, Sarvani Yellayi, Ansh Prasad, and John Kim

Get the latest Via Satellite news!

Subscribe Now