Latest News

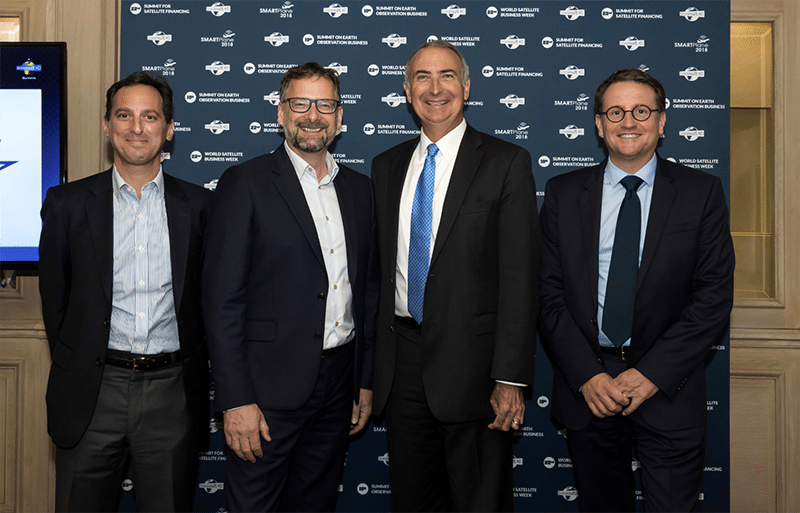

Daniel Goldberg (Telesat), Steve Collar (SES), Stephen Spengler (Intelsat), Rodolphe Belmer (Eutelsat). Photo: Business Wire

The creation of the C-Band Alliance (CBA) by Intelsat, SES, Eutelsat, and Telesat to accelerate making mid‐band spectrum available for 5G services in the U.S. has been the main talking point of the satellite industry this week. Quilty Analytics President Chris Quilty told Via Satellite that the move was a “stroke of genius” as it was “born out of the necessity to wave the white flag” in response to former FCC Chairman Tom Wheeler’s admonishment to “get off the tracks or get run over by the train.”

In terms of the significance of Telesat joining the fray here, Quilty added, “The fact that all four major C-band owners [in the U.S.] have come together in support of the transition plan makes it highly likely, in our view, that a spectrum auction will be successfully concluded. While Telesat’s participation is certainly helpful, it probably wasn’t strictly necessary given the overwhelming support for the effort by regulators, wireless operators, and other spectrum holders.”

Via Satellite was told by a source within one of the big operators that the creation of CBA is seen as a major milestone and a step forward in the management and development of the C-band in the U.S. The move is of little surprise given past announcements by SES, Intelsat and Eutelsat in this area. The CBA is designed to act as a facilitator as described in a recent U.S. Federal Communications Commission (FCC) proceeding featuring the companies’ market-based proposal to clear a portion of C-band spectrum in the United States. The four operators said the formation of the CBA demonstrates the industry alignment necessary to make this mid-band spectrum available quickly, thus supporting the U.S. objective of winning the race to introduce terrestrial 5G services.

Giles Thorne, a satellite equity analyst at Jefferies, had a different take on the announcement and said what was important was what was not said, rather than what was. “What was absent from the CBA release was a commitment to clear 200 Megahertz (the current Joint Proposal is for only 100 MHz) — This is something we think the CBA has actually committed to internally,” he said. “Our view is based on the clear economic incentive to release more spectrum; the evident demand for more than 100 MHz; and the fact it is technically feasible. We think a 200 MHz commitment will emerge imminently, since spectrum re-farming thrives or dies on an ecosystem’s appetite for change — bringing forward a better offer can only help momentum. Equally, there is an incentive to bring forward the revised offer sooner rather than later, given we are mid-Notice of Proposed Rulemaking (NPRM) comments (so there’s no point in elongating the NPRM process by materially changing the terms of reference close to the Ocr. 29 submission deadline).”

Laurie Davidson, a satellite equity analyst at Deutsche Bank, said in a research note that he thought the addition of Telesat was the most material part of the announcement. “A small positive for both stocks (SES and Eutelsat) in adding to their efforts to get C-band proceeds,” he added. “The other parts of the announcement are the appointment of two senior lobbyists, an organizational structure and title; ‘The C-Band Alliance (CBA).’ The C-Band auction in the U.S., we have estimated, could generate as much as $11 billion gross, but SES and Intelsat are the main groups with exposure; SES with 40 percent share, whereas Eutelsat (ETL) share is less than 5 percent. So this is part of our preference to hold SES versus sell ETL, where we still see risks to guidance in this fiscal year (ending July 2019).”

Italy

Speaking of key wireless auctions, the Italian C-band auction took place this week with 200 Mhz of C-band spectrum auctioned on $0.42 per Mhz pop. Exane BNP Paribas Satellite Equity Analyst Sami Kassab said in a research note that the auction could have some good implications for the satellite industry. “This price is at the high end of consensus expectations of $0.2 to $0.4 for U.S. C-band spectrum,” he said. “Our U.S. C-band spectrum pricing assumption of $0.19 has room for upside. The Italian C-band spectrum auction offers a positive read across for satellites and our U.S. C-band spectrum pricing assumption of $0.19 has room for upside. The Italian mobile market has less attractive characteristics than the U.S. market in our view as mobile Average Revenue Per User (ARPU) is lower and spectrum licenses shorter. In other words, U.S. spectrum pricing could be higher. However, the Italian auction was a particularly competitive one driven by the presence of a new entrant and the very structure of the combinatorial clock auction.”

Get the latest Via Satellite news!

Subscribe Now