Latest News

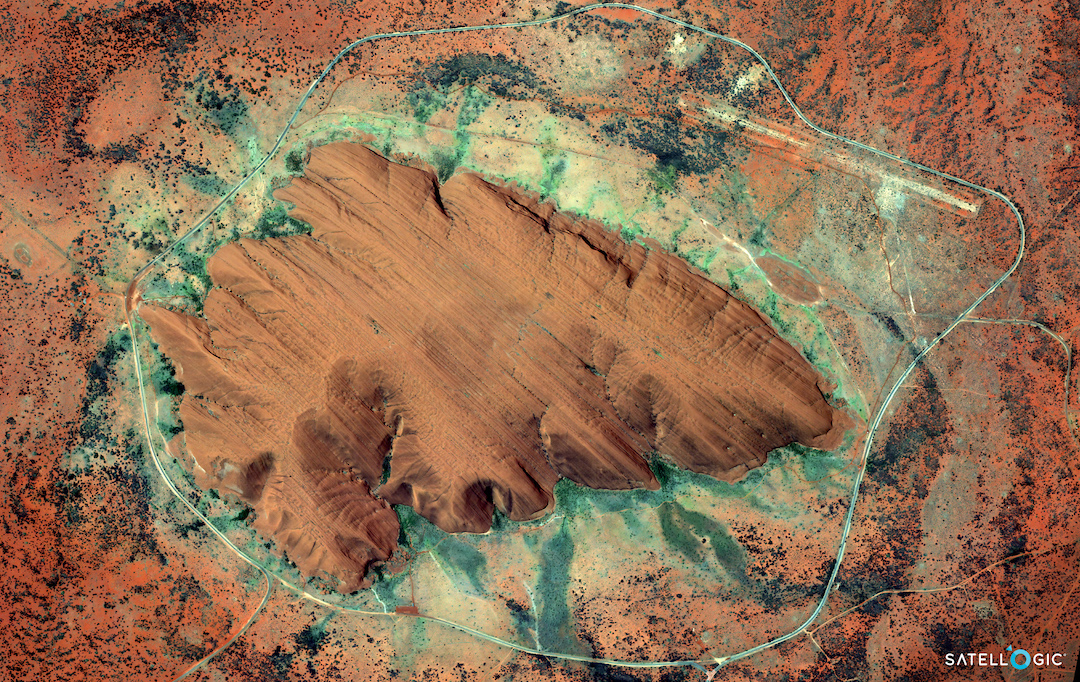

Satellogic imagery of the Uluṟu-Kata Tjuṯa National Park in Australia. Photo: Satellogic

Earth imagery provider Satellogic has begun the process of relocating the company to the U.S., and recently received a $30 million strategic investment from cryptocurrency company Tether Investments Limited.

Satellogic gave a number of updates this week in its 2023 full year financial results. The company reported a 68% revenue increase compared to 2022, calling it “positive momentum,” but “slower than anticipated.”

Satellogic CEO Emiliano Kargieman said the company is redomiciling to Delaware from the British Virgin Islands to compete for U.S. government and allied contracts. Last year the company received approval for a remote sensing license for its constellation with the National Oceanic & Atmospheric Administration (NOAA).

“With these two steps, we anticipate targeting new U.S. government contract opportunities in 2024, in addition to our current pipeline of international government and commercial opportunities,” Kargieman said.

Separately, the company announced a $30 million strategic investment from Tether Investments Limited. The company is known for Tether tokens, which are the most widely adopted type of stablecoin cryptocurrency.

Financial Results

Satellogic CFO Rick Dunn said that while the company was “encouraged by our positive momentum, we experienced slower than anticipated revenue growth.”

Revenue for 2023 increased 68% to $10 million, compared to revenue of $6 million in 2022. The increase was driven primarily by the Space Systems and Asset Monitoring lines of business.

Net loss for the year was $61 million, compared to a net loss of $36.6 million in 2022. The company ended the year with $23.5 million of cash on hand.

Dunn said the company moderated CapEx spending in 2023, reduced discretionary spending and reduced headcount by 25% at the beginning of the year.

“We continue to expect that our revenue for 2024 will largely be dependent on closing opportunities within our Space Systems line of business, which we anticipate will contribute considerable per unit cash flow and strong gross margin, although that revenue may be heavily weighted to the second half of the year,” Dunn said. “As we look to 2024 and beyond, we are focused on executing on our strategic realignment and growth opportunities in the U.S. market. We continue to expect our revenue will be driven by our further growth in Space Systems, Asset Monitoring, and Constellation-as-a-Service.”

Satellogic did not provide guidance, saying the sales cycle is long and subject to many variables outside of company control.

Stay connected and get ahead with the leading source of industry intel!

Subscribe Now