Latest News

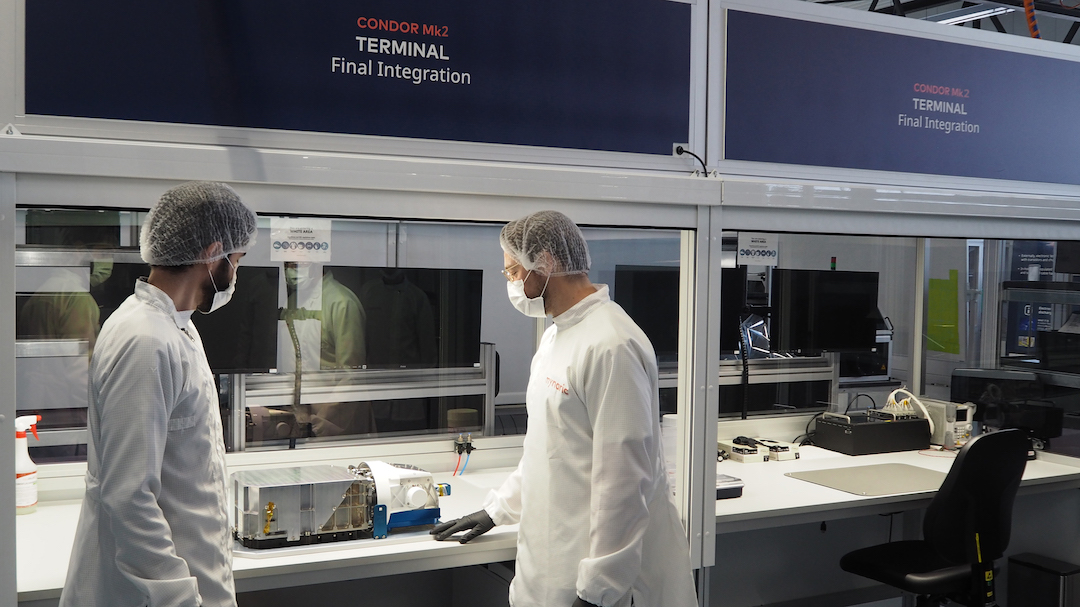

Mynaric Condor Mk2 terminal integration. Photo: Mynaric

Mynaric is experiencing production delays on its laser communication terminals, causing the company to slash its revenue guidance. Mynaric updated its guidance on August 20 and also announced the company’s CFO Stefan Berndt von-Bulow left the company for personal reasons last week.

Mynaric now expects revenue in 2024 to range between 16 million euros to 24 million euros ($18 million to $27 million). Its previous guidance was between 50 million euros to 70 million euros ($56 million to (78 million).

Mynaric explained, “the guidance decrease is due to production delays of Condor Mk3 caused by lower than expected production yields and component supplier shortages of key components.”

Mynaric also changed its guidance on cash-in from customer contracts, now expecting 45 million euros to 50 million euros ($50 million to $56 million), compared to previous guidance of 65 million euros to 100 million euros ($72 million to $111 million). The guidance decrease is mainly driven by lower shipments and delays in the program awards relative to previous expectations.

The metric cash-in from customer contracts includes payments from customers under purchase orders and other signed agreements, including accrued payment milestones under customer programs.

Mynaric is also running low on cash and had 6.3 million euros ($7 million euros) of cash on hand as of August 16, 2024. Mynaric said it needs to pursue additional capital to secure ongoing operations and production. “At this time, we are evaluating a number of different strategic options to address our near-term capital needs,” the company said.

The company manufactures optical communication terminals (OCTs) for space, air, and ground platforms, and began volume production on the Condor Mk3 laser terminal for satellites in April. For the satellite industry, its technology is designed to increase the speed and security of data transfer between spacecraft.

Mynaric’s contracts include a deal with Northrop Grumman to supply optical communications terminals for the SDA’s Tranche 1 Transport and Tracking Layer programs and by York Space Systems for the SDA’s Tranche 1 Transport Layer. Mynaric was also selected by Loft Federal to supply the Condor Mk3 terminals to NExT – the SDA’s Experimental Testbed. Other deals include the Defense Advanced Research Projects Agency (DARPA) Space-BACN program and ReOrbit.

In terms of the CFO role, CEO Mustafa Veziroglu and CTO Joachim Horwath will assume the responsibilities of the CFO while Mynaric looks for a new CFO.

Get the latest Via Satellite news!

Subscribe Now