Latest News

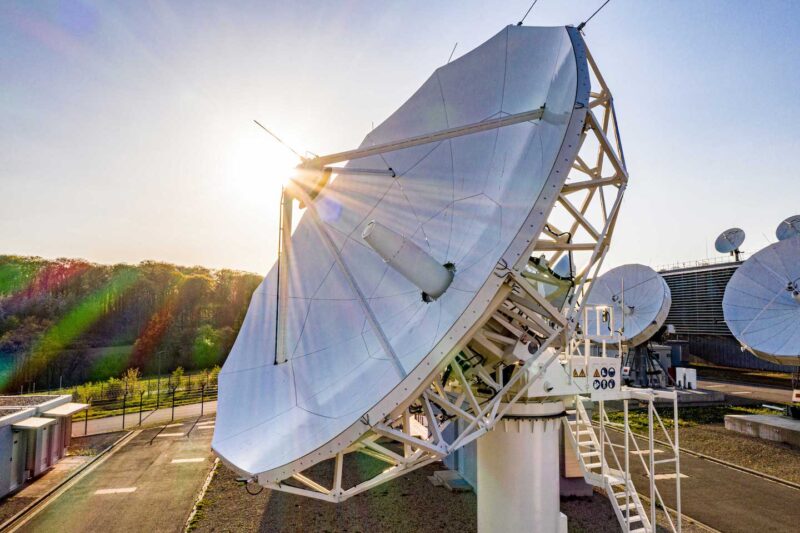

SES headquarters in Luxembourg. Photo: SES

SES has secured a 3 billion euro ($3.2 billion) financing package to fund the Intelsat acquisition, the company announced on June 19.

Before the deal was announced, Deutsche Bank AG and Morgan Stanley had jointly underwritten a $3.2 billion bridge facility to support SES’s financing requirements. SES reported the bridge facility has been successfully syndicated to an international group of existing relationship and new banks in the form of a $2.25 billion bridge facility and U.S. $1 billion term loan.

SES also secured a two-year extension of the $1.3 billion revolving credit facility from 2019, which the company said ensures backup liquidity to June 2028 with a group of 19 banks.

“We are delighted to have received overwhelming support of our banking partners in the financing of this important and transformational transaction for SES,” SES CFO Sandeep Jalan commented. “The bridge facility provides SES with financing flexibility from a capital markets issuance perspective while the term loan serves as a source of long-term financing.”

SES’s pending $3.1 billion acquisition of Intelsat brings together two of the largest satellite operators for a combined company with around $4 billion in revenue, more than 100 satellites in Geostationary Orbit (GEO), and 26 satellites in Medium-Earth Orbit (MEO).

Get the latest Via Satellite news!

Subscribe Now