Latest News

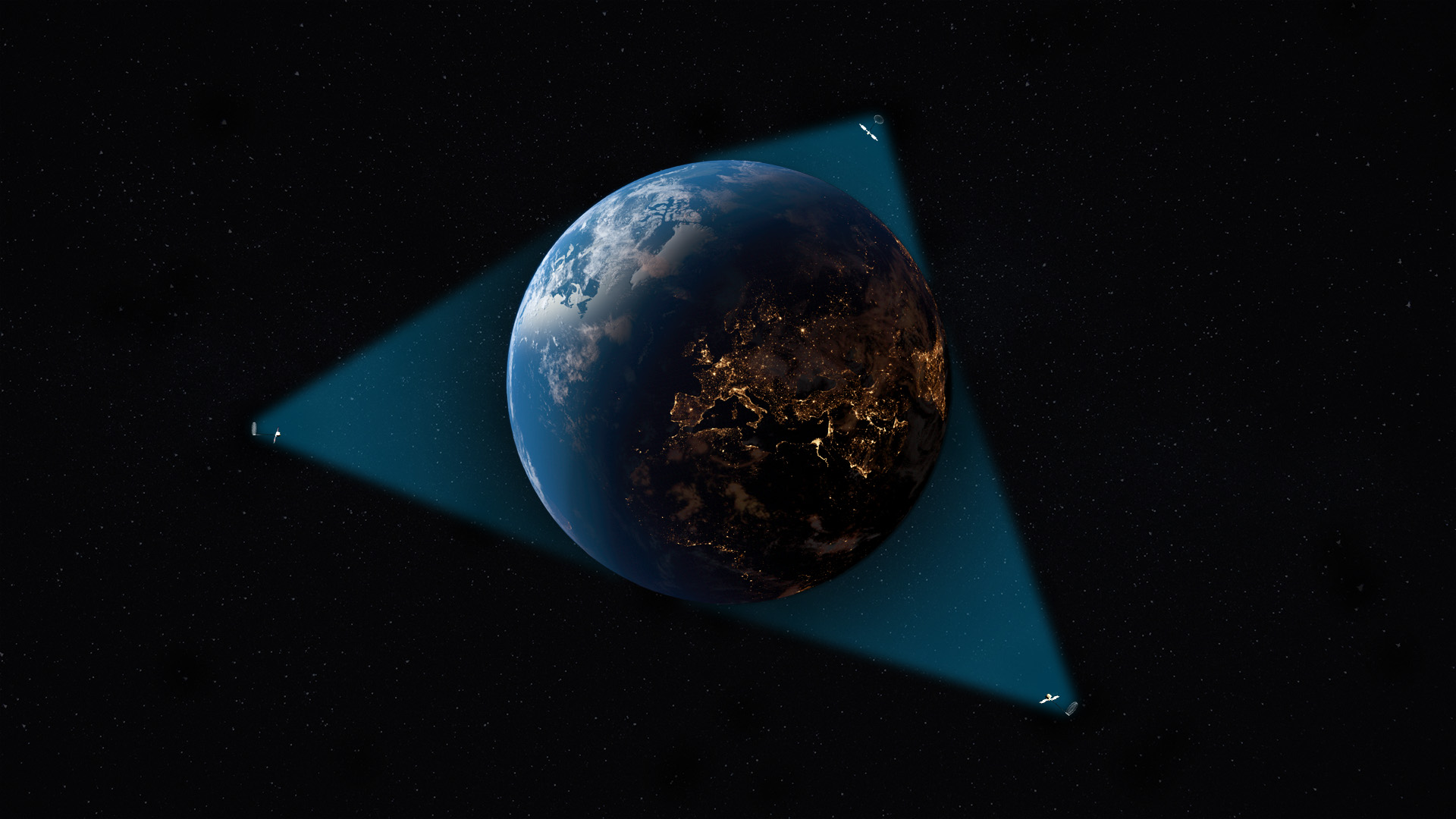

The ViaSat-3 constellation. Photo: Viasat

Viasat posted record revenue for fiscal year 2024, its first year including Inmarsat’s contribution, post-acquisition. But the company’s stock dipped 16% on Wednesday as Viasat projected flat revenue in the coming year due to competition in the broadband market and delays with aircraft connectivity installations.

The satellite operator delivered record revenue of $4.3 billion in fiscal year 2024, a 68% increase from $2.6 billion a year ago. This is the first year to include Inmarsat’s contribution after Viasat closed the transaction on May 30, 2023.

Fiscal year revenue and adjusted EBITDA growth was above the high end of prior guidance, which CEO Mark Dankberg said was driven by growth in mobility and government. Adjusted EBITDA was $1.4 billion from continuing operations, a 181% year-over-year increase. Despite the full-year growth, adjusted EBITDA in the fourth quarter declined by 3% year-over-year.

The company posted a net loss from continuing operations of $1.06 billion due to the satellite anomalies and costs with the Inmarsat acquisition and integration.

Commercial in-flight connectivity (IFC), a key business for Viasat, ended the year with 3,650 aircraft in service, up about 17% year-over-year. There are more than 1,350 aircraft in backlog.

“Fiscal year 2024 was a big year for us,” Dankberg told investors on Tuesday. “We closed the Inmarsat acquisition, dealt with the satellite anomalies, immediately undertook integrating the companies to eliminate redundancies, capture synergies and drive productivity.”

ViaSat-3 Deployment Update

Viasat took over control of the ViaSat-3 F1 satellite from manufacturer Boeing during the fourth quarter. The operator gave an update on service plans for the satellite, which was impacted by an anomaly on its reflector array.

Viasat expects the satellite to enter commercial service later this quarter, and reported that it recently demonstrated speeds over 200 Mbps to an aircraft.

Dankberg confirmed the satellite is delivering about 10% of the expected capacity.

“That’s from a total bandwidth perspective,” he said. “The big thing is that we still have really good flexibility in how we apply that bandwidth, so it will punch above its weight relative to older satellites in those markets.”

Viasat submitted an insurance claim for the satellite and has collected about 55% of the $421 million expected. Viasat has collected the full $348 million claim on the I-6 F2 satellite, which also had an anomaly.

In terms of the two upcoming satellites, Viasat expects to bring ViaSat-3 F2, into service in late calendar year 2025. The third satellite, F3 is expected to enter service in mid to late calendar year 2025, a little over a year from now.

Outlook and Opportunity for FY 2025

In fiscal year 2025, Viasat expects roughly flat revenue growth year-over-year and low to mid-single-digit year-over-year adjusted EBITDA growth.

Satellite Services revenue is expected to decline with the decline of U.S. fixed broadband revenue while Viasat prioritizes capacity for the mobility business.

Dankberg did not share subscriber numbers for the U.S. consumer broadband business, which faces competition from Starlink. He said Viasat may be able to flatten the decline or improve the revenue in the future, “depending on the amount of bandwidth that we allocate to that market.”

The higher margin mobility services will offset some of the broadband decline, but Dankberg said the Alaska Airlines incident on a Boeing 737 plane in January has cut deliveries of 737s in half, impacting a number of Viasat customers.

CFO Shawn Duffy said the company expects to have around 4,200 aircraft in service by the end of fiscal year ’25.

Viasat is incorporating both the VS3-F2 and VS3-F3 entry into service into its financial outlooks for FY2026. The operator said there will be no impact from these satellites in FY2025.

Viasat confirmed prior guidance that it expects to hit positive free cash flow by the end of the first quarter of fiscal year 2026.

The satellite operator also said that moving forward, it will have a new segment reporting structure. The two reportable segments will be Communication Services and Defense and Advanced Technologies. Viasat will report revenue data for each of the major business units within each segment.

“Despite some challenges, our operational performance in FY’24 and Q4 was good, and we are capturing substantial operational and capital synergy,” President Guru Gowrappan told investors. “In FY’25, we expect to make significant progress on our satellite road map and towards positive free cash flow with good increases in operating cash flow and moderated CapEx.”

Stay connected and get ahead with the leading source of industry intel!

Subscribe Now