Latest News

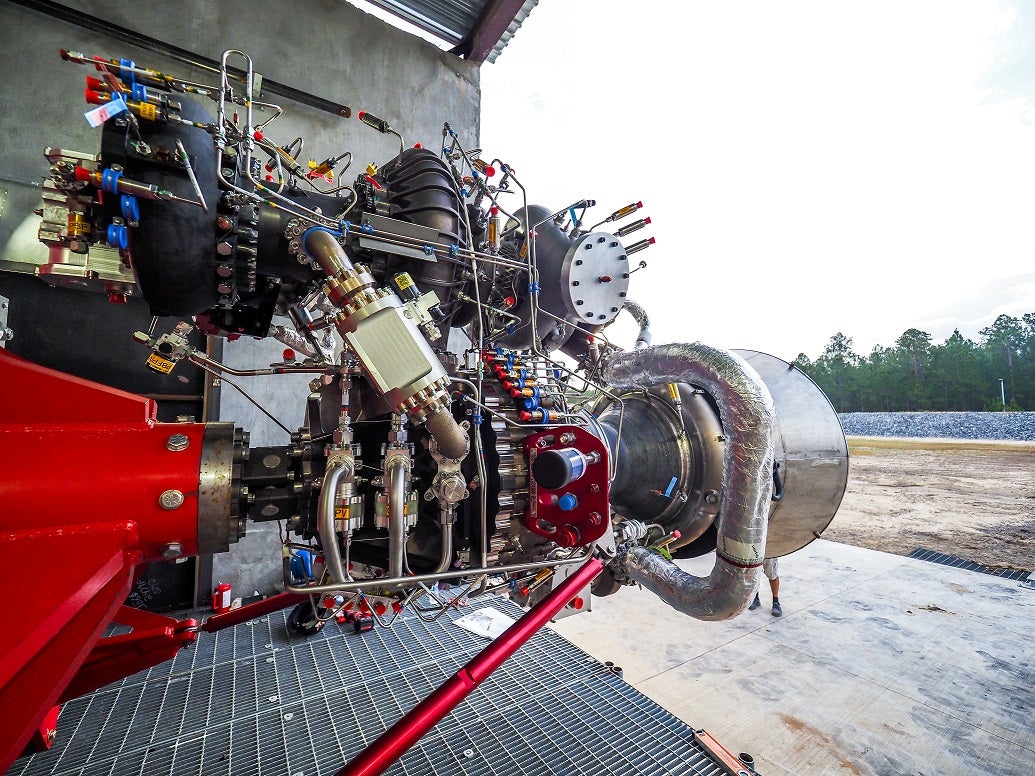

Rocket Lab completed the first full assembly of its Archimedes engine. Photo: Rocket Lab/@akd_ams

Rocket Lab reported a record $93 million in revenue in the first quarter of 2024 — a 69% year-over-year revenue increase. The launch and space systems company released its Q1 2024 financials on May 6, along with the update that the first launch of its next-generation Neutron rocket will slip to mid-2025 at the earliest.

Rocket Lab has completed the first full assembly of the Archimedes engine that powers the Neutron rocket and has started an intensive test campaign leading up to the first hot fire. The Archimedes test campaign will take place at Rocket Lab’s dedicated engine test stand at NASA’s Stennis Space Center in Mississippi.

CEO Peter Beck emphasized in a Monday call with investors that Rocket Lab’s focus was on bringing a flight-like engine to test, versus a minimum viable product. Rocket Lab invested in its production infrastructure alongside the engine development so it can quickly move into production.

“The point here is not to just make fire,” Beck said. “The point here is to roll into production. And there’s a number of new processes and actually even new materials that we developed for Archimedes. … “The time that it takes to stand up the factory and the machine that builds the machine is probably the biggest learning.”

Rocket Lab previously targeted a first launch for Neutron in 2024.

First Quarter Results

Rocket Lab delivered record total revenue of $93 million in the quarter, up 55% quarter-over-quarter and 69% year-over-year. This was toward the low end of prior guidance.

The Q1 revenue increase was driven by an increase in the number of launches during the quarter and growth in the Space Systems business. Rocket Lab performed four Electron launches during the quarter.

The Launch business contributed $32.7 in revenue, and the Space Systems business contributed $60 million in revenue.

According to CFO Adam Spice, the average selling price per launch in Q1 was $8.2 million, above the average selling price of $7.5 million.

Rocket Lab’s gross margin in Q1 of 32% was roughly flat sequentially due to weaker mix in the Space Systems business. However, the gross margin improved from the year-ago period, when it was 18% in Q1 2023.

Adjusted EBITDA loss during the quarter was $22 million.

Rocket Lab reported $1.015 billion in backlog at the end of the quarter, down 3% sequentially, due to the amount of revenue realized during the quarter against the backlog. Rocket Lab expects approximately 42% of this backlog to be recognized within 12 months.

The company provided guidance for the second quarter, expecting revenue between $105 million and $110 million. Rocket Lab expects a non-GAAP gross margin between 30% and 32%, and adjusted EBITDA loss of $23 million to $25 million.

Potential Acquisitions on the Horizon

In February, Rocket Lab closed a private offering of $355 million convertible senior notes. Spice said the funds put Rocket Lab in a strong position to further vertically integrate its supply chain with acquisitions.

“We raised a significant amount of capital in this most recent transaction,” Spice said. “It was all about providing inorganic growth optionality for us. We continue to see significant opportunities out there. The deal pipeline that we’re managing at this point is probably as full as it’s been in really the last couple of years, as far as potential actionable targets for us.”

Get the latest Via Satellite news!

Subscribe Now