Latest News

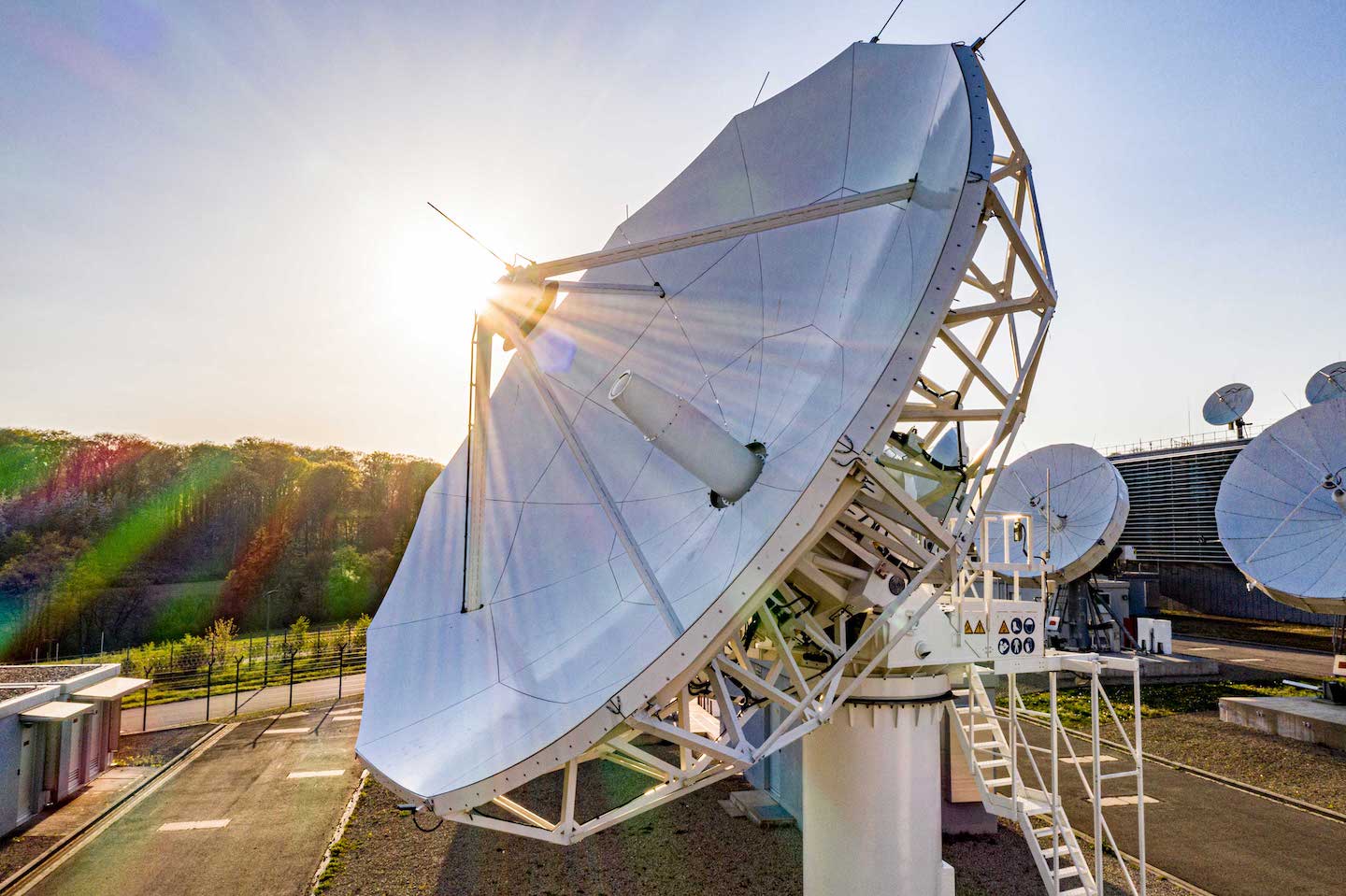

SES headquarters in Luxembourg. Photo: SES

SES and Intelsat closed the chapter on the will they/won’t they story, with news on Tuesday that SES will acquire Intelsat for $3.1 billion. It is a massive piece of industry consolidation, bringing together two of the largest satellite operators for a combined company with around $4 billion in revenue, more than 100 satellites in Geostationary Orbit (GEO), and 26 satellites in Medium-Earth Orbit (MEO).

SES CEO Adel Al-Saleh pitched the merger as bringing the companies together to create a player with a stronger multi-orbit position in the market to deliver better offerings in high-value markets like government and mobility.

“This is a highly dynamic market. There’s new competition. This market is moving very fast, new LEO [Low-Earth Orbit] entrants are launching constellations. Having scale and a multi-orbit capability is critical to success. Being isolated or cornered into one part of the market without having the breadth and capability to compete is a difficult way to compete in this market,” Al-Saleh told analysts and investors on April 30.

“The stronger positioning in a multi-orbit capability gives us ways to deliver [solutions] to clients that we would struggle to deliver independently,” he added.

Analysts say the deal could improve SES’s competitive positioning against the dominance of SpaceX’s Starlink constellation, and the upcoming Amazon Kuiper constellation, particularly in areas where there is direct competition, like milsatcom and in-flight connectivity.

“But it’s not a guaranteed solution to the thorny problem,” Mike Thompson, Access Partnership practice director for Space & Policy tells Via Satellite. “Starlink and others are poised to eat SES’s lunch. SES has to move quickly.”

The Time Was Right

SES and Intelsat have been rumored to be in talks for a merger or acquisition for years. Last summer, the companies ended talks just days after SES’s longtime CEO Steve Collar announced plans to depart.

Suzanne Ong, vice president of Communications for SES, told Via Satellite on Tuesday that talks started up again in spring of this year, and those talks have led to a swift conclusion. She did not say that last year’s resolution was a mistake, but rather that the timing was right now.

“The transaction was agreed to when both companies felt comfortable with the terms and that the transaction would create a combined company that would be able to compete better in the industry,” Ong said.

CEO Al-Saleh took the helm of SES in February, and his move to acquire Intelsat mirrors similar recent industry consolidation. After joining Eutelsat, CEO Eva Berneke quickly moved to acquire OneWeb, and former Inmarsat CEO Rajeev Suri reached a deal with Viasat a few months after starting in his role as well.

Al-Saleh told investors on Tuesday that strategic discussions at SES were already underway before he joined about how SES should use its C-band proceeds to stay competitive in the long term. He said that both he and Intelsat CEO David Wajsgras worked hard together to figure out how to make the acquisition happen. Previous discussions addressed a merger, but Al-Saleh said this acquisition model was easier to reach a deal on.

“It was clear to us that this particular transaction, if we were able to successfully close it with the right type of value, is the most compelling proposition we have on the table for the company, for our shareholders, for our employees,” Al-Saleh said. “That’s why we went very fast. It didn’t take me long to understand the options.”

“There’s a lot of things that made it different,” he added. “But the biggest thing was the desire of both companies to build something unique here. We both saw that opportunity to create something valuable to our clients and to the market and to solidify the company for the long term.”

Intelsat CEO Wajsgras commented that this comes after a “remarkable strategic reset” for Intelsat, which returned the company to growth.

“Communication and connectivity needs for our customers are changing,” Wajsgras said in a video message. “By forming a stronger company as part of SES, we will be better equipped to meet those needs going forward, and better equipped to serve important public interests by uniting complimentary networks and offerings. We’ll also be able to offer deeper and broader choice of products and services, with greater, coverage, capacity, and resilience.”

All-Cash Transaction to Close in 2025

SES will pay $3.1 billion to acquire all of Intelsat’s equity in an all-cash transaction. The acquisition is funded using existing cash resources of about $2.6 billion and new debt, supported by a committed bridge facility. Additionally, SES will issue contingent value rights for any potential future monetization of the combined collective usage rights for up to 100 MHz of C-band spectrum.

Wajsgras confirmed that Intelsat’s employee team is an “important part” of the transaction.

The combined company will remain headquartered in Luxembourg, with continued presence in the greater Washington, D.C. area.

Both boards of directors unanimously approved the deal, and it has the support of Luxembourg government shareholders. The deal is subject to regulatory clearances. Al-Saleh said SES expects the deal to close in the second half of 2025.

SES pointed to 2.4 billion euros of synergies ($2.6 billion), and that 70% of those synergies will be executive within three years of closing the deal.

Al-Saleh said he expects that SES will have to work through antitrust concerns, but he is confident there will be a positive outcome. “There is some work we need to do. We don’t take it just lightly that it’s just a slam dunk. But we don’t we don’t foresee an issue in that area,” he said.

Combined Opportunity in Government and Mobility

SES reported the combined company has 2024 expected revenue of 3.8 billion euros ($4 billion). The current combined backlog is worth 9 billion euros ($9.6 billion). SES said growth will come from high-growth Government, Mobility, and Fixed Data businesses, anchored by a Media business with solid cash generation fundamentals.

Both companies have gone through transformations in recent years from being primarily broadcast-focused to a focus on networks, managed services, and mobility markets. About 60% of revenue of the combined profile is dedicated to growth markets.

SES has 43 GEO satellites, 26 Medium-Earth Orbit satellites, and seven more upcoming MEO satellites. Intelsat has 57 GEO satellites, four upcoming software-defined GEO satellites, and a distribution agreement for Eutelsat OneWeb’s Low-Earth Orbit (LEO) capacity.

Al-Saleh told investors that the combined company will have roughly an 800 million euro ($855 millIon) business in Government; 800 million euro business in Mobility ($855 millIon) with aero, cruise, and maritime; and a 600 million euro ($641 million) business in Data and Cloud.

He pointed to the value of the combined cash generation and the investments it will enable a combined company to make.

“Being in a position with strong cash generation that allows you to invest without having to stress your balance sheet and over leverage yourself is very important to be a healthy player in the marketplace,” Al-Saleh said. “It allows you to invest in your network infrastructure using the latest technologies like we’re doing with additional software-defined satellites. It allows you to build vertical solutions for clients. It gives you an ability to integrate things, to create software that makes it easier for our customers to use our solutions.”

Al-Saleh added it gives the combined company the opportunity to diversify, citing interest in quantum key distribution, Internet of Things (IoT), direct-to-device, and Earth observation.

Analysts See Synergies, Question Competitive Edge

Will the combined entity be in a better position to compete against the likes of Starlink and Amazon? Access Partnership Director Thompson said that the combination of the two sets of assets does not insulate the combined entity against the new competition, but it may buy time to develop competing networks of their own.

“Starlink and OneWeb have demonstrated it is possible to build mega-LEO networks, but they have not yet demonstrated that they are commercially sustainable. SES/Intelsat may have a chance to build a mega-LEO of their own, discount their current GEO assets, and leverage their extensive customer bases,” Thompson said.

“The industry is facing rapid change, and we have already seen many smaller players swallowed up. The decline in transponder revenues – particularly with satellite broadcasters scaling back – continues to threaten investment in new capacity, especially with the new megaLEOs snapping at the heels. SES has already increased investment in their non-GSO system (O3b), but they may need to buy time to fully compete in the new space,” Thompson added.

He said the merger is a “logical move” for SES, but does not seem overly enthusiastic about the deal, calling it “at best, a stop-gap solution.”

“It will give SES better pricing flexibility, as well as unparalleled global coverage and capacity,” Thompson said. “But they need to persuade customers to stick with them rather than jump ship to the plucky startup.”

Nathan de Ruiter, partner and managing director of Novaspace told Via Satellite that the combined network assets does not necessarily make the combined entity directly better positioned to Starlink and Amazon. He said the impact really varies by vertical market.

“Consumer broadband is neither a target market for SES or Intelsat. On the other hand, the combination will improve the competitive positioning in Milsatcom and Aero IFC, where there is an established service business that will directly compete with Starlink and Amazon,” de Ruiter said.

He also added that as a result of this move, SES will clearly be the largest satellite operator from a wholesale perspective. Novaspace estimates that the combined entity will have a 28% market share of all satellite capacity leasing, and 32% market share in transponder leasing for video applications.

De Ruiter sees a strong rationale in terms of cost synergies. “Based on a first-level assessment of the combined satellite fleet, we can already identify 6 to 8 satellites with near term end-of-life that would potentially not require a replacement. This would already be a CapeX cost savings upwards of $1 billion. In addition, there are significant potential savings to be achieved in operations and staffing costs,” De Ruiter said.

Armand Musey, president and founder of advisory firm Summit Ridge Group, said anti-trust concerns could be the biggest problem for the acquisition, especially in North America. The issue might not be with consumer or enterprise broadband, but with North American video services dominated by Intelsat and SES, the U.S. Department of Defense, and potentially the aviation market.

“It may come down to whether regulators see new high throughput satellite operators such as Hughes and Viasat, and LEO operators such as Starlink, as sufficiently developed to be viable competition across Intelsat and SES’s customer segments,” Musey told Via Satellite. “If not, it may require a divestiture of some satellite assets to get the deal done.”

A New Era

For SES, it is the start of a new era, and one that it hopes will mean it will remain one of the largest global operators.

Ong pointed to the fact that SES has long been on the record pushing for industry consolidation, arguing that there are too many players in the market. Intelsat CEO Wajsgras has made the same argument.

“Market shifts and new entrants have created a new era of satellite innovation, growth and increasingly dynamic competition,” Ong said. “The combined company will better compete with highly capitalized and rapidly scaling LEO entrants as well as terrestrial players by providing the resources and flexibility to invest and innovate in new capacity and services for all customer segments.”

Get the latest Via Satellite news!

Subscribe Now