Latest News

A rendering of Momentus’ Vigoride in-space shuttle. Photo: Momentus

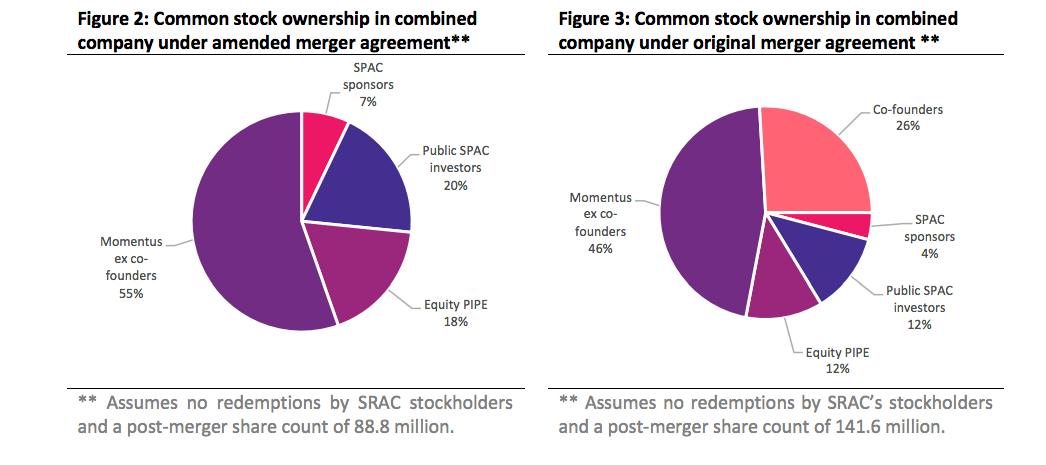

Momentus has cut its valuation in half as it has gone through challenges with its special purpose acquisition company (SPAC) merger. The in-space transportation company announced June 29 that it is amending its pre-transaction valuation from $1.131 billion to $567 million. The combined company’s valuation has been revised from $1.2 billion to $700 million.

The company has dealt with national security concerns related to foreign ownership since it announced the SPAC deal in October 2020, as founding CEO Mikhail Kokorich and co-founder Lev Khasis are both Russian citizens. Kokorich stepped down in January and both co-founders have now completely divested from the company. This affected flight approval for its Vigoride orbital transfer vehicle, and the U.S. Federal Aviation Administration (FAA) denied approval.

Momentus recently signed a National Security Agreement (NSA) with the U.S. Department of Defense and Department of the Treasury on behalf of the Committee on Foreign Investment in the United States (CFIUS), with specific steps to amend the national security concerns. This puts the company on a path to move forward.

Momentus said Tuesday that long-term financial outlook has been pushed back about 18 months because of the delays in its launch schedule. It is still working to receive government launch approval and projects the Vigoride’s first flight for June 2022.

Brian Kabot, CEO of Stable Road Acquisition Corp., the SPAC that is working to combine with Momentus, said the SPAC sought a more favorable deal terms for public stockholders and PIPE investors because of the delay in financial targets. “We believe this revised merger agreement significantly helps to compensate our investors for the change in schedule and results in a more attractive investment case for them,” Kabot said.

Kokorich, Khasis, and related entities have sold their equity, which was approximately 36% of the total equity. This increases the equity of both current Momentus shareholders and SRAC stockholders and PIPE investors.

SPAC shareholders will vote to approve the business combination on August 13. With the delays in Momentus launch schedule, this means the company could be publicly traded for nearly a year before its spacecraft is validated with flight heritage.

Visualization of Momentus’ ownership structure. Graphic via Momentus.

Get the latest Via Satellite news!

Subscribe Now