Latest News

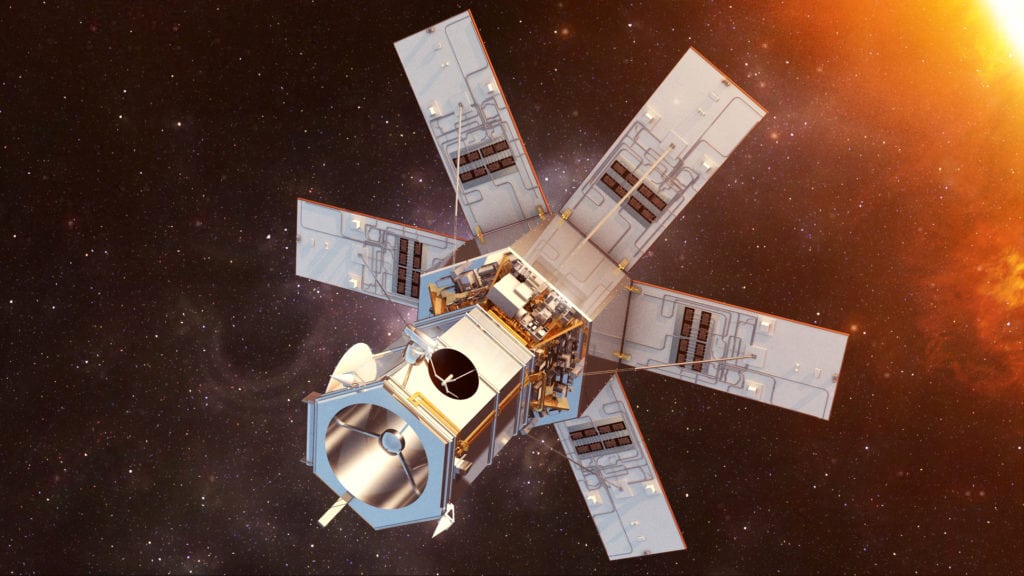

Artist’s rendition of WorldView 4. Photo: DigitalGlobe

Glancy Prongay and Murray (GPM), a global investors rights law firm, revealed that a class action lawsuit has been filed on behalf of investors that purchased or otherwise acquired Maxar Technologies securities between March 29, 2018 and Jan. 7, 2019, inclusive. Maxar investors have until March 15, 2019 to file a lead plaintiff motion.

On Aug. 7, 2018, Spruce Point Capital published a report claiming that Maxar “has pulled one of the most aggressive accounting schemes Spruce Point has ever seen to inflate Non-International Financial Reporting Standards (IFRS) earnings by 79 percent,” and that the company’s “$3.7 billion of rising debt with almost no cash and free cash flow” necessitates that Maxar “eliminate its dividend immediately, or risk wiping out equity holders.” On this news, Maxar’s share price fell more than 13 percent on Aug. 7, 2018.

Then, on Jan. 7, 2019, Maxar disclosed that WorldView-4 had experienced a failure in its Control Moment Gyroscope (CMGs), preventing the satellite from collecting imagery due to the loss of an axis of stability. On this news, the Company’s stock price fell $5.69 per share, or 48.5 percent, over the following two trading sessions, to close at $6.03 on January 8, 2019.

The complaint filed in this class action alleges that the defendants failed to disclose that Maxar improperly inflated the value of its intangible assets, among other accounting improprieties; Maxar’s highly-valued WorldView-4 was equipped with CMGs that were faulty and/or ill-suited for their designed and intended purpose; and as a result, Maxar’s public statements were materially false and misleading at all relevant times.

Get the latest Via Satellite news!

Subscribe Now