Latest News

Last week, we published a new, exclusive interview with Telesat CEO Dan Goldberg talking about the operator’s plans for 2018, particularly around Low Earth Orbit (LEO). So, for our throwback Thursday feature we turn the clock back 10 years to a major interview we did with Goldberg when he first took over at Telesat and discussed what the challenges were for the company then.

This article was originally published in November 2008.

Telesat, led by former New Skies Satellite CEO Dan Goldberg, returned to the upper echelon of Fixed Satellite Services (FSS) operators following the acquisition of Telesat Canada by Loral Space and Communications in October 2007.

The company’s 12-satellite fleet is far smaller than its larger rivals but gives Telesat a strong North American presence, a stronger footprint in international markets and a global teleport and fiber infrastructure. Goldberg expects demand for High-Definition (HD) services will be the key to strong growth in the next 12 months.

VIA SATELLITE: How are you going to use your experience as CEO of New Skies Satellite to drive Telesat?

Goldberg: At New Skies, I gained a familiarity with the markets and customers that Skynet has been servicing over the years. As a result, the Skynet business was in no way alien or foreign, even though legacy Telesat had little or no experience in these markets. My familiarity with these markets was helpful as we planned the integration of Skynet and Telesat and, I believe, will be useful as we look for ways to expand our business.

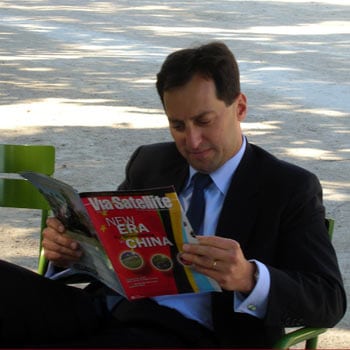

Dan Goldberg reading Via Satellite in 2008. Photo: Via Satellite

VIA SATELLITE: What do you see as the other drivers for Telesat’s business?

Goldberg: We are going to see significant growth over the next 12 months driven by the fact that we are launching three new satellites. When I look at two of those satellites, Nimiq-4 and Nimiq-5, they are already 100 percent sold out to Bell TV and EchoStar, who need the capacity for the introduction of additional advanced television services. Probably the most important advanced services these satellites will be used for is HDTV so, in that regard, HD is driving our growth today. Beyond that, we are launching another new satellite, Telstar 11N, which will be in the Atlantic Ocean region. That is an all Ku-band satellite serving North America, Europe and Africa as well as the Atlantic Ocean in terms of maritime capacity. That will also drive some growth. The demand drivers for T11N are principally services to, from and within Africa and the maritime and aviation services market.

VIA SATELLITE: Is there a mobile TV opportunity for Telesat?

Goldberg: Right now it is a very nascent market. Telesat has a significant portion of our revenues coming from North America. It is not the case today that mobile TV is ubiquitously and widely available in North America. I think that mobile television will come to be just that, ubiquitously and widely available. I think consumers will adopt it quickly and consume it quite a bit. For FSS players, I think the most obvious near term opportunity is to use our fleets to create an overlay infrastructure for the terrestrial distribution network. Satellites really do provide an excellent infrastructure to distribute video out to the fixed terrestrial infrastructure, really the tower infrastructure, and from there it will go to the handsets.

VIA SATELLITE: Do you see a stronger relationship developing between Bell Canada and Telesat?

Goldberg: Bell Canada remains a very significant customer of ours, indeed our largest customer, through pay-TV as well through some of their enterprise service activities, including providing services to remote communities. I think that there’s a good opportunity to continue to grow our business with Bell Canada as they roll out more and more innovative services to Canadian consumers and businesses.

VIA SATELLITE: What are your plans in the satellite broadband market in the United States?

Goldberg: Telesat truly is a pioneer in the broadband Satellite Today market. As a result, today, we are providing capacity on Anik F2 for WildBlue in the United States and for nearly 50,000 subscribers in Canada as well on Anik-F2 and F3. The service has been successful, so much so that we are experiencing capacity constraints today. That means we are looking at ways we can efficiently expand our Ka-band capacity, working with existing customers. We have an option for the Canadian payload on ViaSat-1 satellite and that could represent a very efficient opportunity for us to expand our capacity meaningfully in Canada.

VIA SATELLITE: Have you been surprised by the take-up of WildBlue?

Goldberg: I was surprised at the quick ramp-up, but once the service demonstrated itself and it became apparent that there was strong, pent-up demand for these applications, I have not been surprised since. Two years ago, I realized this service was for real. I wouldn’t say I had skepticism about these services initially, but I was surprised just how steep the ramp up was.

VIA SATELLITE: Are there any other growth opportunities worth mentioning?

Goldberg: The government business continues to be quite strong for us, both U.S. government and non-U.S. government requirements. Regionally, demand is fairly strong in Africa, the Middle East, Latin America and certain parts of Asia. There are different drivers in those markets including demand for GSM backhaul, enterprise services, government projects and video distribution.

VIA SATELLITE: What is the international opportunity for Telesat?

Goldberg: One year ago, the perception of Telesat as principally a regional North American operator was 100 percent correct. Most of our revenues were coming from North America, although we did have one satellite serving Latin America. With the merger between Telesat and Skynet, however, that situation literally changed overnight. As of November 1 last year, we are capable of serving virtually every market in the world. Notwithstanding this, many still perceive Telesat as a North American only operator, and we have some ways to go to help the market understand that we are a global operator. This is one of the reasons why we brand our international satellites as Telstar. The Telstar satellites have brand recognition in all of the markets in which they operate.

VIA SATELLITE: What percentage of your revenues do you generate internationally? How could that change?

Goldberg: If you look at customer billing address, around 85 percent of our revenues come from North America. If you look at it what percentage of the revenues are coming from international assets, I would say 20 percent to 25 percent are coming off our international assets. That is a significant portion. When we launch the Nimiq-4 and the Nimiq-5 satellites, that will tip the balance back to North America. When we launch T11N at the end of the year that is more of an international focus. Skynet has always participated in virtually every market around the world and we’re focused on growing both within and outside of North America.

VIA SATELLITE: What are your capital expenditure plans beyond these three satellites?

Goldberg: We have some replacement satellites after that, and the first ones will be on the international side. We have a good number of expansion slots in North America, and we continue to see some promising opportunities on both the broadband side and the video distribution side in North America. We are looking to grow our business around the world, and this will be driven by the commercial opportunities available.

VIA SATELLITE: Are there opportunities for Telesat in terms of acquisitions or is there more of a focus on organic growth?

Goldberg: I think it will continue to be both. The larger operators will grow their businesses organically and look to find good opportunities to grow through acquisition as well. There are many compelling reasons to look to grow through mergers and acquisitions. A significant amount of value can be created. I think there is more of that to take place.

Get the latest Via Satellite news!

Subscribe Now