Latest News

Dankberg: ViaSat 3 Satellite Will Have More Capacity than the Rest of the World Combined

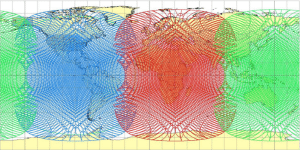

[Via Satellite 02-10-2016] ViaSat projects that its next generation satellite system will have more capacity than all the other telecommunications spacecraft in the world. The company is aggressively developing ViaSat 3, a trio of geostationary high capacity satellites where each spacecraft will be capable of more than a terabit per second of network capacity.

Speaking during ViaSat’s third quarter 2016 earnings call, Chairman and CEO Mark Dankberg said that ViaSat 3 is already progressing much faster than ViaSat 2 because of several years of accumulated work. When the spacecraft is ready, it will more than double the amount of bandwidth in orbit, according to Dankberg.

“Each ViaSat 3 satellite is anticipated to have as much bandwidth as all the rest of the satellites in the world combined. And that includes all of the High Throughput Satellites (HTS) that are now under construction,” he said.

Development of the ViaSat 3 system will consist of a lot of vertically integrated work by the company. Dankberg said ViaSat has experience building satellite payloads from a subcontract with Thales Alenia Space related to Iridium Next. Boeing, announced in a Feb. 10 press release as the build partner for the first two ViaSat 3 satellites, will have a somewhat smaller role.

“The way that we structured our contract with Boeing is essentially they are giving us the payload framework for us to attach our modules to,” explained Dankberg.

Compared to the space between ViaSat 1 and ViaSat 2, which is expected to be about five years, Dankberg said the company is targeting a gap of only about two years between ViaSat 2 and the first ViaSat 3 spacecraft. He said the company would have benefited from launching ViaSat 2 much earlier, but that the technology was simply not ready.

“We have been investing steadily for years in the successor for ViaSat 2, so this time we are aiming to cut that gap between satellites roughly in half while still getting an even bigger boost in productivity,” he said. “We are planning to launch ViaSat 3 Americas in mid-calendar 2019 and ViaSat 3 in the Europe, Middle East, [and] Africa (EMEA) region for early 2020.”

The third ViaSat 3 satellite targets the Asia-Pacific market.

ViaSat’s soonest satellite to launch, ViaSat 2, recently switched from SpaceX to Arianespace, and is now scheduled to launch in the first quarter of 2017. ViaSat 2 was booked for a Falcon Heavy launch late this summer, but that was prior to SpaceX’s Commercial Resupply Services-7 (CRS-7) mission where a Falcon 9 rocket exploded roughly two minutes after takeoff. The launch mishap not only delayed the Falcon 9, but pushed back the debut of the Falcon Heavy, which uses three Falcon 9 engine cores. Dankberg said insurance pricing for the Falcon Heavy was also much higher than for the Ariane 5.

In between ViaSat 2 and 3, Dankberg said the company is evaluating options for interim capacity with partner Eutelsat. ViaSat and Eutelsat have worked together for 10 years and struck up an agreement in July 2014 for service access and roaming between KA-SAT and ViaSat 1. Recently the two companies have tightened their partnership to include the formation of a joint venture.

The new company will start by using KA-SAT, which covers Europe and the Mediterranean Basin, for a wholesale broadband business and a new consumer retail service. ViaSat plans to invest roughly $150 million for 49 percent interest in the wholesale services business, which will start with KA-SAT and is later expected to leverage the ViaSat 3 EMEA satellite. For the retail business, ViaSat will own 51 percent, and Eutelsat 49 percent. This division would be focused on building a direct-to-consumer Internet Service Provider (ISP) business in Europe.

ViaSat and Eutelsat anticipate the transaction will close in the second quarter of 2016, subject to regulatory approvals and other customary closing conditions. Dankberg listed Eutelsat’s strong presence in Europe, including regulatory and landing rights positions across the continent, and inventory of orbital slots as reasons for the partnership.

“And as we have seen in the U.S., there is a very high congruence between the people who have satellite Internet and the people who have satellite TV, so working with a leading satellite TV provider is a strong position,” he added.

Dankberg said interim capacity for Europe could come in the form of a “quick production” satellite such as the Boeing 702SP, or potentially using an existing Ka-band payload, but that these paths are still being evaluated.

Once launched, ViaSat 2’s coverage includes not only the Americas and Caribbean, but also a bridge with Eutelsat to the U.K. and Europe for high-speed In-Flight Connectivity (IFC) and other mobile services. Dankberg said ViaSat 2’s projected in-service date is Q1 2018. Furthermore, the terminals for ViaSat 2 will be forward compatible with ViaSat 3. Dankberg mentioned IFC, general aviation and government as top markets for upcoming satellites, along with maritime. He said the company has added more than 100 unannounced aircraft recently from existing airline customers as they enact fleet modernization programs.

ViaSat expects its future satellites will be much more profitable than their predecessors. Dankberg said the useful bandwidth on the two WildBlue satellites generated combined revenue of about $200 million, and $80 million in annual adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA). Today ViaSat’s run rate is an adjusted EBIDTA of almost $250 million a year, of which Dankberg attributed about 90 percent to ViaSat 1. He said productivity gains from future satellites look to be even more profitable.

Get the latest Via Satellite news!

Subscribe Now