Latest News

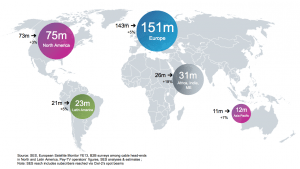

[Via Satellite 03-19-2014] SES has expanded its reach to more than 291 million TV homes around the world, with 151 million located in Europe. According to SES’ “2014 Satellite Monitor” report, of the 291 million TV homes, 106 million are satellite homes, more than 153 million are cable homes, and more than 32 million are Internet protocol TV (IPTV) homes. Europe remains a strong market for SES, with 75 percent of satellite homes serviced by the company. However, while SES has seen growth in this region, the majority of its total growth seen in 2013 came from international markets.

In 2013, SES increased its presence in Europe by 5 percent, compared to 7 percent in Asia Pacific and 18 percent in India. Latin America grew by also 5 percent, but new upcoming satellite capacity presents an opportunity for expansion. SES has already ordered two of four planned satellites. The SES 10 satellite, intended to replace AMC3 and AMC4 in Latin America, will offer 50 Ku-band transponders. This is an increase of 22 compared to its predecessors. Slated for launch onboard a SpaceX Falcon 9 in Q2 of 2016, the satellite is to be located at 67 degrees west, an orbital slot where Telefónica Digital is the largest customer.

“This latest satellite confirms SES’ statement that the vast bulk of its growth capex will be oriented toward high-growth markets, particularly Latin America and Asia,” said Sarah Simon, analyst at Berenberg Capital Markets in a research report. “We note that the company has good supply of orbital rights in both markets, particularly in the former. Indeed, we would not be surprised to see at least one more satellite ordered for launch into this market. DTH and data demand is very strong in Latin America, and, with an existing business (sales force, contacts, contracts), SES is well positioned to serve this market in our view.”

SES worked with the Andean Community to identify the 67 degrees west orbital slot, and some of SES 10’s capacity will be allocated for governmental purposes. The Colombian state-owned operator Señal Colombia currently broadcasts from this location. Still, the increase in transponders will allow SES room for new customers.

Overall, SES continues to show growth year over year. The company’s direct reach to satellite homes grew from 99 million in 2012 to 106 million in 2013. SES also had significant relative growth of its direct reach in other emerging markets. Asia-Pacific grew by 21 percent, and Africa, the Middle East and India grew by 18 percent. In Europe SES satellites cover 95 percent of cable and IPTC homes, as well as 81 percent of HD homes. Germany continues to stand as SES’ largest single DTH market on the continent.

“Our strong growth is a direct result of our significant investments in new satellites especially in the highly important and dynamic emerging markets,” said Ferdinand Kayser, CCO of SES. “We could also further take advantage of our strong infrastructure and service offerings in mature markets and realize further gains, on a high level, in Europe and North America.”

Simon’s research report pointed out that O3b, whose fleet is being collaboratively built by SES, Google, Liberty Global and various financial investors, stands as another source of growth for SES. The maturation of the Ultra-HD market should also influence capacity deals, as an NPD report projects the Ultra-HD penetration will exceed 8 percent by 2017.

“We reiterate SES as a key pick within European media,” said Simon in the research note. “It offers above-sector average organic growth, dividend and free cash flow yield, while at the same time having the ability to return up to 30 percent of its market capitalization through special dividends and/or buybacks. In our view there is nothing within the media sector, at the present time, that offers such high total shareholder returns.”

Get the latest Via Satellite news!

Subscribe Now