Latest News

|

|

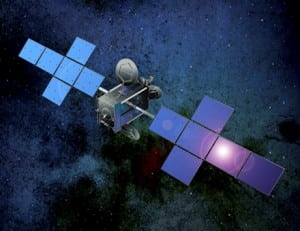

Built by Space Systems/Loral, the EchoStar 15 was moved to the 45-degree orbital slot to demonstrate DBS capabilities.

Image credit: SSL

|

[Satellite TODAY 08-16-13] EchoStar reported $830 million in revenue for the second quarter of 2013, an increase of 3 percent compared to the same period last year. During a conference call with investors, David Rayner, EchoStar’s CFO and executive vice president demonstrated how Hughes’ Internet service earnings have served as a boon for EchoStar’s bottom line.

“In our Hughes Internet service business, we have added another 44,000 subscribers in the second quarter of 2013, continuing the strong performance since the launch,” Rayner said.

According to EchoStar’s CEO, Michael Dugan, in the past 3 quarters starting with the launch of Hughes’ Gen4 service on October 1, the company added a net of 140,000 subscribers, ending the second quarter of 2013 with a total of 736,000 subscribers.

Besides Internet services, the company also reported positive results for its other units. “Hughes’ non-customer order input in the second quarter of 2013 also accelerated at a strong pace with 206 million in new orders, a 71 percent increase over the second quarter of 2012,” Dugan added, noting that key contributors to the strong growth were Row 44, Digital Deluxe and Telefonica.

Hughes’ current service footprint covers approximately 480 Southwest Airlines and Norwegian Air Shuttle aircraft. Additionally, Digital Deluxe selected Hughes Europe to provide managed high bandwidth connectivity services to more than 3,000 cinemas in the U.K., Germany, France, Italy and Spain during the initial phase, with the goal of expanding to more than 8,600 cinemas across Europe within 5 years, Dugan said. “This will transform film distribution in Europe from physical hard-disk delivery to cloud-based content delivery,” he added.

According to Dugan, the strong order activity resulted in an order backlog of approximately $1064 million for his Hughes business at the beginning of third quarter 2013, compared to $968 million at the same time last year, which together would be approximately $1290 million of contracted backlog.

EBITDA was $149 million compared to $184 million last year, Rayner said, noting that the decline was primarily caused by the impairment loss of $35 million due to anomalies on the EchoStar 12 satellite. “Over time, EchoStar 12 has been experiencing loss of electrical power. Our ongoing engineering analysis has concluded that further loss of power is likely, thereby reducing future revenue-producing capacity,” he added.

Net income attributable to EchoStar shareholders in the second quarter was a loss of $9.8 million and diluted loss per share was $0.11, compared to net income of $35.7 million and diluted earnings per share of $0.41 in the second quarter last year, Rayner said.

“Our free cash flow, defined as cash flow from operations less capital expenditures, was $57 million in the current quarter as compared to the $58 million use of cash in the second quarter of 2012,” Rayner said. “As of June 30, we had $1.6 billion of cash and marketable securities giving us adequate resources to pursue our planned growth opportunities.”

Capital expenditures for the quarter were $86 million, compared to $164 million last year, which Rayner attributed to lower satellite spending. “Last year, we had both Echo 16 and 17 in late-stage construction. This year, we’re in the early stages of construction of Echo 19. For the full year 2013, we are expecting capital expenditures to be in the range of $365 million to $385 million,” he said.

But on a more positive note, Dugan said that on the business development front, EchoStar continues to actively pursue a joint venture initiative to enter the Brazilian DTH market. “Negotiations with potential partners have progressed considerably, although not to a point where I can provide many details. We have moved EchoStar 15 into the 45-degree orbital slot to demonstrate the capability of the high power DBS satellite and initiate the testing of the various aspects of the service. We will be ready to quickly launch our service once we have an agreement,” he said.

“Results have been very positive and, in addition, we continue to explore our international opportunities to deploy satellite-based platforms around the world,” Dugan added.

Get the latest Via Satellite news!

Subscribe Now