Latest News

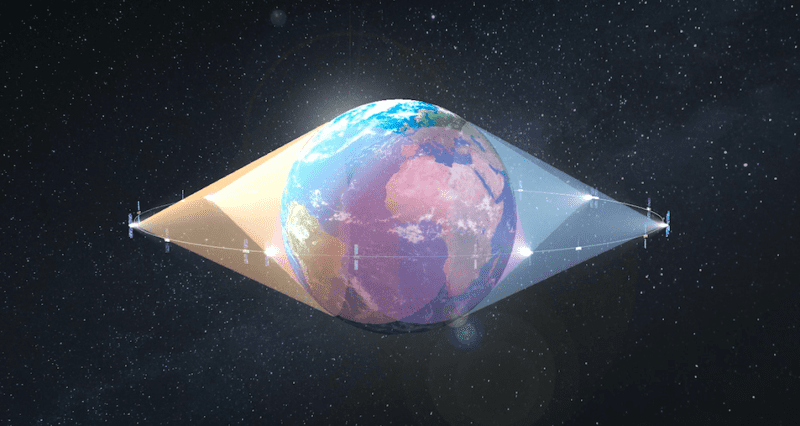

A visualization of SES’s O3b mPOWER. Photo: SES

SES is pushing back the start of commercial service for its O3b mPOWER constellation to early in the second quarter of 2024, as it deals with power module issues on the satellites. To deal with the impact to the constellation, SES “reshaped” its contract with manufacturer Boeing to upgrade five of the remaining satellites and add two new satellites to the constellation.

CEO Ruy Pinto gave an update on the next-generation Medium-Earth Orbit (MEO) program on Tuesday during SES’s third quarter 2023 call with investors. In August, SES reported “trip offs” on some of the power modules on board the four satellites on orbit.

Since then, Pinto said there have been an increased number of these sporadic power module switch offs including a few non-recoverable events. These initial satellites will have a “significant reduction” in their expected lifetime and available capacity.

To deal with the impact to the constellation, SES and Boeing are upgrading five of the remaining satellites — satellites seven through 11 — and adding two additional satellites to the constellation. Pinto told investors that SES finalized the agreement with Boeing on Monday to share risk and CapEx.

“It’s important for Boeing and for SES that the new technology works flawlessly in space and that we can deploy it with our customers,” Pinto said. “Adding a common objective with Boeing was essential to the negotiation that involved reshaping the contract where both companies took an element of risk in the delivery and in the capital expenditure and in adding capabilities to the constellation.”

Pinto said SES is investigating whether to pursue an insurance claim on the satellites and it will depend on the performance of the satellites in orbit. Boeing could “possibly” share in insurance proceeds, he said.

Pinto did not give specific details on the financial deal with Boeing, but said SES should be able to deploy the additional satellites without impacting its CapEx envelope and without depending on any potential insurance proceeds.

This follows after last week, Boeing reported $315 million of losses in the third quarter from an undisclosed satellite program. CFO Brian West said the costs came from additional work and customer considerations on an innovative program with new technology.

With the change to the service start date, SES adjusted financial expectations for next year. mPOWER was previously expected to enter service by the end of this year. SES expects the delay to lower 2024 revenue and adjusted EBITDA by a mid-single digit percentage.

SES is manifested to launch the fifth and sixth mPOWER satellites on a SpaceX launch targeted for November 12, Pinto confirmed. Those satellites will help the constellation enter service in the second quarter of 2024.

Pinto assured investors that with mitigations in place, SES will be able to support its customers. “We expect that with the mitigations in place, our existing O3b MEO constellation customers will be supported, as well as O3b mPOWER customers, with still room for further customer and market growth from early Q2 next year,” Pinto said.

SES Third Quarter 2023 Results

SES’s revenue in the third quarter of 2023 was 507 million euros ($537 million), up 3.1% year-over-year. In the third quarter, the Video segment reported 241 million euros ($255 million) in revenue, down 2.5% year-over-year.

The Networks segment delivered revenue of 267 million euros ($283 million), up 8.8% compared to the same time last year. Within the Networks segment, Government saw the most growth at 14.7% increase year-over-year. Fixed Data revenue increased 6.3% year-over-year, and Mobility increased 1.5% year-over-year.

Pinto confirmed SES is on track to deliver on its full-year outlook for 2023.

During Q3, the operator received its $3 billion USD pre-tax payment from the FCC for clearing the C-band on an accelerated timeline.

Using a portion of the proceeds, SES is initiating a 150 million euro ($159 million) share buyback program in November. SES announced the buyback in August. SES is also redeeming a hybrid bond worth 550 million euro ($582 million) in January 2024, which Pinto said is in line with the company’s objectives to reduce leverage and lower the overall cost of debt.

“We are pleased with a solid year-to-date financial performance and remain fully on track to deliver on our 2023 financial outlook. We achieved year-on-year growth in all three of our main Networks segments and secured important Video renewals which underpin the long-term cash generation and value of our broadcast business. Solid EBITDA performance underscores our focus on managing controllable costs across the business,” Pinto commented on the results.

Pinto led the results call as CEO. The company recently announced that Adel Al-Saleh will become SES’s new CEO in February next year.

Stay connected and get ahead with the leading source of industry intel!

Subscribe Now