Latest News

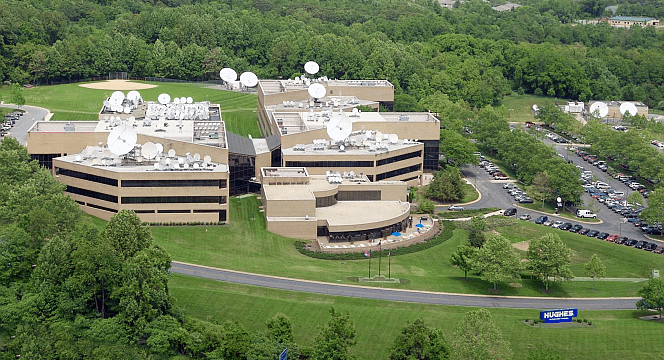

Hughes Network Systems campus in Germantown, MD. Photo Credit: Hughes

Hughes Network Systems broadband business continues to shed subscribers, as the company is constrained on satellite capacity awaiting the launch of the Jupiter-3 satellite. Hughes parent company EchoStar Corporation released its third quarter financials on Nov. 3, confirming the Jupiter-3 satellite is progressing at Maxar and is still expected to launch during the first half of 2023.

EchoStar reported consolidated revenue of $497.4 million, almost all attributed to Hughes. Revenue decreased 1.4% in Q3 compared to the same time period in 2021.

Net income was $19.6 million, compared to $30.2 million in the same time last year. EchoStar said the decrease was primarily due to lower operating income of $15.6 million and an unfavorable change in investments of $13.8 million.

Hughes broadband subscribers totaled approximately 1,285,000 at the end of September. This was a decline of 61,000 from the end of June. The company said current capacity limitations and competitive pressures are impacting consumer subscriber levels.

In Latin America, subscriber levels were also impacted by adverse economic conditions, more selective customer screening, and Hughes allocating capacity to higher value enterprise and government applications.

Lower service revenue of $31.4 million was primarily due to lower broadband consumer customers, but this was also partially offset by higher equipment sales of $24.1 million.

During the quarter, 60% of Hughes segment revenue was attributable to consumer customers, with approximately 40% attributable to enterprise customers.

EchoStar CEO Hamid Akhavan said on a call with investors on Nov. 3 that Starlink has impacted Hughes’ broadband business “to some degree.”

“We are not really focused on just maximizing the number of consumers. We are looking at maximizing yield. We may have less consumers now, but we have a growing ARPU,” Akhavan said. “So our revenue per customer has grown on a quarter-over-quarter basis. So we’re keeping great customers. Again, we maximizing yield. … We are not as focused on the number of customers more than what we get out of the consumer business, both domestically and internationally.”

Cash, cash equivalents and current marketable investment securities were $1.6 billion as of September 30, 2022.

“We remain focused on operating the business in an efficient manner while also preparing for the launch of our Jupiter-3 satellite. We have capitalized on enterprise market opportunities, and I am pleased that we have increased sales of equipment, primarily developed in-house, for both the three and nine month periods ending September 30, compared to the same periods last year. We continue to seek opportunities in pursuit of our strategy of being a global connectivity and services provider,” commented Akhavan.

Stay connected and get ahead with the leading source of industry intel!

Subscribe Now