Latest News

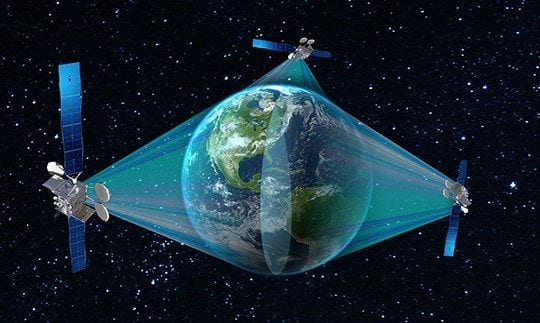

A rendering of the ViaSat-3 constellation. Photo: Viasat

Viasat continued its streak of record revenues in the third quarter of fiscal year 2022, but pushed the highly anticipated Viasat-3 satellite launch to late summer.

The company provided an update on the Viasat-3 program in Thursday’s financial results and said supplier issues caused the schedule slip. The satellite has been pushed back before, and previously was targeted for launch in the first half of 2022.

“We’ve been working through limited availability of specific critical skill workers,” CEO Rick Baldridge said on Thursday’s investor call. “We’ve made really good progress on Alpha testing of our space-ground system integration, using one of our on-orbit satellites. We’re looking to take advantage of that to manage on-orbit testing so we can maintain commencement of initial services by the end of the calendar year, consistent with what we said before. We don’t expect this to materially affect our financial outlook.”

The first ViaSat-3 payload is being readied for thermal vacuum testing at Boeing, which the company called a major milestone in final spacecraft integration.

This first satellite will cover the Americas, and is one of three. Viasat said about 95% of the payload unit has been installed on the second satellite, which will cover Europe, the Middle East, and Africa. It is set for launch about six months after the first. Also this week, Viasat announced Australian telecommunications company Telstra as a partner for the ground deployment for the third satellite which will cover the Asia-Pacific region.

Inmarsat Acquisition Update

Viasat also provided an update on its Inmarsat acquisition that was announced in November. Baldridge said Viasat is progressing on the regulatory front. The company completed the required loan amendment on Viasat’s $700 million revolver, and the amendment of Inmarsat’s $1.7 billion term loan and $700 million revolving credit facility.

Inmarsat is reporting financial performance ahead of pre-COVID levels from 2019, with revenue growth of 11% for both the quarter and 9 months ended September 30, 2021, compared to the same time periods in 2020.

A number of airlines have reached out to Viasat with interest in the acquisition and how it will affect their service. Executive Chairman Mark Dankberg on the call that said airlines are interested in hearing about how the acquisition will affect bandwidth density to avoid network congestion at busy airports, hybrid Ka-band and L-band services for continuity of service in bad weather conditions, and redundant, global coverage.

Viasat continues to expect the deal to close between nine and 18 months after signing, likely by the end of the calendar year.

Third Quarter Results

Viasat continued its streak of record revenue in Q3 2022, reporting $720 million in revenue for the quarter, up 25% from the same time last year. Each quarter this year has achieved record revenue — $665 million in Q1, and $701 million in Q2.

Overall revenue growth was driven by acquisitions of RigNet and Euro Broadband Infrastructure (EBI), broad-based service revenue growth, and strong product sales.

Viasat posted a net loss of $6.6 million for the quarter, compared to $6.8 million in income in the prior year quarter due to higher depreciation and expenses related to the acquisition.

The Satellite Services segment saw the largest revenue increase in Q3, with revenue of $310 million, up 40% compared to Q3 2021. This was a new record and the sixth consecutive quarter of sequential growth. Viasat said this revenue boost was due to growth in in-flight connectivity (IFC) services, steady fixed broadband performance, and the RigNet and EBI acquisitions.

Mobility is an increasing portion of this segment’s revenue, and made up 37% of total Satellite Services revenue this quarter. Viasat expects sustained growth in the IFC service fleet as an additional roughly 860 commercial aircraft are expected to start service on Viasat IFC networks under existing agreements.

U.S. fixed broadband revenue was flat year over year, but had higher ARPU. Viasat said there was a slight decrease in subscriber numbers because the company is reallocating bandwidth to mobility services.

The Government Systems segment reported $270 million in Q3, up 2% compared to the same time last year. This was led by growth in services revenue from government satcom system services, higher government aircraft mobile broadband utilization, and cybersecurity. Tactical satcom radio and tactical data link products drove higher produc revenues.

Viasat said this segment is seeing a bottleneck in new security assurance products sales because of U.S. government certification delays caused by government staffing shortages.

The Commercial Networks segment revenue for the quarter was $140 million, up 55% year over year, due to higher mobility terminal shipments, increased deliveries for advanced antenna systems products, and product revenues from RigNet. Viasat said the advanced ground antenna systems business portfolio in this segment saw 30% year over year revenue growth driven by full motion antennas and earth observation products.

Company-wide awards for the quarter totaled $569 million, 12% lower than a year ago because of an exceptional quarter for Commercial Networks last year. Viasat ended the quarter with a backlog of $2.1 billion, slightly lower compared to the prior year period.

Get the latest Via Satellite news!

Subscribe Now