Latest News

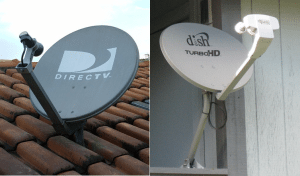

[Via Satellite 04-01-2014] News of talks between Charlie Ergen, chairman of the board of Dish, and Mike White, CEO of DirecTV, fueled a brief rise in the stocks of both companies last week. The news, which Bloomberg brought to light, has reignited discussions on whether a merger is possible. Dish and DirecTV attempted to merge in 2001, but the United States Federal Communications Commission (FCC) and the Department of Justice (DOJ) shut it down in 2002 over anti-trust concerns. As stocks return to normal, it is yet to be seen whether or not regulators will feel any different in 2014.

“I don’t think anybody knows under this administration,” Marci Ryvicker, managing director of equity research for media and cable at Wells Fargo, told Via Satellite. “The issue back in 2002 was in a lot of markets you were going from three providers to two, and two providers to one … I just spent a day with the FCC on March 14, and I think that this current FCC would have a tough time allowing a DirecTV-Dish merger to go through.”

The media business has changed significantly since 2002, however. The cable industry has seen a number of mergers since then, and even now discussions are continuing about conflating Comcast and Time Warner Cable. Technology has also changed significantly. Media companies are working to provide content for a myriad of devices, and over-the-top (OTT) services are further changing the competitive landscape.

“The primary motivation for the merger is to enhance the combined strength of the Direct-to-Home (DTH) players in a market that is evolving rapidly,” said Chris Quilty, SVP of equity research at Raymond James and Associates. “The North American pay-TV market has seen flat to declining growth. In that environment where the market appears to be saturated and there is the possibility of cannibalization from OTT services, it requires the companies to look at alternative business models.”

Should the merger go through, Quilty believes it would provide an opportunity for EchoStar, sister company of DISH and the owner-operator of the majority of the satellite fleet used for the delivery of DISH’s DTH TV services, to purchase DirecTV’s fleet of 10 operational satellites. DirecTV is currently the only major DTH service provider to operate its own satellite fleet. The purchase could provide indirect funding for the transaction, as well as lower the long-term capital intensity of the unified company.

“Based upon the recent Dish swap agreement that was valued at approximately $700 million for five satellites, a transaction would presumably be valued in the ballpark of $1.5 billion, with adjustments for the age, orbital locations, and transponder capacity of the satellites,” said Quilty in a research note. “EchoStar currently has $1.6 billion of cash on hand, with additional borrowing capacity of more than $4 billion.”

The merger could also open a path for EchoStar to sell its set-top-box (STB) product line to DirecTV. Today this is not feasible due to competitive reasons. As Dish and DirecTV look for positive synergies, they also need to be aware of ways they can jointly expand. According to Ryvicker, the two companies need to look toward goals and revenue opportunities that would make their case more appealing to regulators.

“There could be situations where there are big enough concessions and big enough promises [that] the FCC might agree to it,” she said. “For example, if Dish and DirecTV build out a wireless network and become a fourth or fifth wireless player. Taking a video competitor out of the market might not be as big of a deal, especially if we are adding a wireless competitor to the marketplace. That’s the only situation where I would see them being allowed to get together, but it’s tough to say.”

Both analysts agree that the merger, if successful, would be a boon for both companies. Management teams from Dish and DirecTV believe the synergies between them are as high as $30 billion Net Present Value (NPV). Combined marking, few satellites and lower corporate overhead are cited as some of the reasons why the merger would make the combined entity more competitive.

“You have two companies who compete against each other that would be a really powerful player, and I think that’s how the market has always view it: they are stronger together than they are apart,” said Ryvicker. “It’s really accretive for both of them.”

Get the latest Via Satellite news!

Subscribe Now